Today is Monday, Feb. 23, the 54th day of 2026. There are 311 days left in the year.

Today in history:

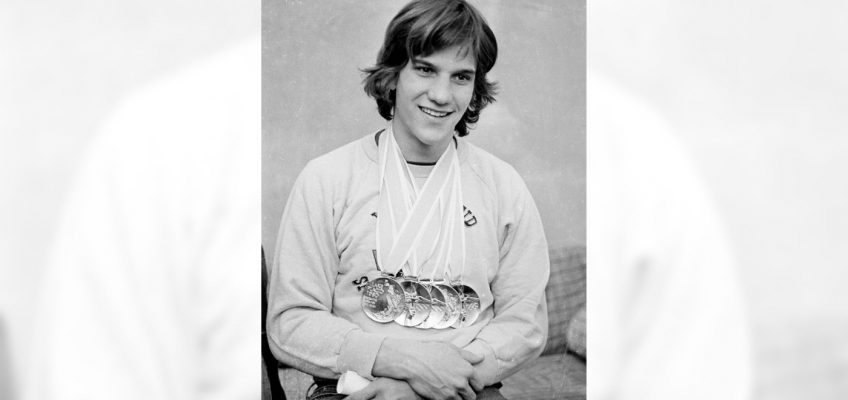

On Feb. 23, 1980, American Eric Heiden completed his sweep of the five men’s speed skating events at the Winter Olympic Games in Lake Placid, New York, by winning the men’s 10,000-meter race in world record time; Heiden was the first athlete to win five gold medals in a single Winter Olympics.

Also on this date:

In 1836, the siege of the Alamo by Mexican troops began in San Antonio, Texas. Almost all of the nearly 200 heavily outnumbered Texas defenders, including American frontiersman and politician Davy Crockett, were killed in the 13-day assault.

Related Articles

How Trump will use his State of the Union address to sell skeptical midterm voters on his plans

Mexico fears more violence after army kills leader of powerful Jalisco cartel

China, India among winners after US court blocked Trump tariffs

Never Trump Republicans are still issuing dire warnings. Is anyone listening?

Trump’s Mar-a-Lago has seen security issues through the years. Here’s a rundown

In 1903, President Theodore Roosevelt signed an agreement with Cuba to lease land around Guantanamo Bay to the United States. No date was set for termination of the lease and Naval Station Guantanamo Bay continues at the site, along with a high-security detention complex for suspected terrorists.

In 1942, the first shelling of the U.S. mainland during World War II occurred as a Japanese submarine fired on an oil refinery near Santa Barbara, California.

In 1945, during World War II, U.S. Marines on Iwo Jima captured Mount Suribachi, where they raised two American flags. (The second flag-raising was captured in an iconic photograph by Joe Rosenthal of The Associated Press.)

In 2011, in a major policy reversal, President Barack Obama’s administration said it would no longer defend the constitutionality of the Defense of Marriage Act, a federal law banning recognition of same-sex marriage.

In 2020, a 25-year-old Black man, Ahmaud Arbery, was fatally shot while running in a coastal Georgia neighborhood after a white father and son armed themselves and pursued him. (Greg and Travis McMichael and neighbor William “Roddie” Bryan subsequently drew life sentences for murder convictions and later were convicted of federal hate crimes.)

In 2021, golfer Tiger Woods was seriously injured when he crashed his SUV into a median and rolled over several times on a steep downhill road in suburban Los Angeles.

In 2023, a federal judge handed singer R. Kelly a 20-year prison sentence for his convictions that include producing child sexual abuse materials and federal sex trafficking charges., but said he would serve nearly all of the sentence simultaneously with a 30-year sentence imposed a year earlier on racketeering charges.

Today’s birthdays:

Football Hall of Famer Fred Biletnikoff is 83.

Actor Patricia Richardson is 75.

Singer Howard Jones is 71.

Japanese Emperor Naruhito is 66.

Actor Kristin Davis is 61.

Business executive Michael Dell is 61.

TV personality-business executive Daymond John is 57.

Actor Niecy Nash is 56.

Democratic Sen. Angela Alsobrooks of Maryland is 55.

Country singer Steve Holy is 54.

Actor Kelly Macdonald is 50.

Rapper Residente, born René Juan Pérez Joglar, is 48.

Actor Josh Gad is 45.

Actor Emily Blunt is 43.

Actor Aziz Ansari is 43.

Actor Dakota Fanning is 32.

Star guard Jamal Murray of the NBA’s Denver Nuggets is 29.

Actor Emilia Jones is 24.