As of January, the Texas governor had about $105,000,000 sitting in his campaign account. That’s an impressively gargantuan figure, especially so given that he was forced to deplete nearly his entire cash cache four years ago in a reelection fight against two hard-line primary challengers and, then, an equally well-funded Democratic opponent, Beto O’Rourke.

As Greg Abbott nears the end of three terms, or a dozen years, and sits at the apex of political power in Texas, the one thing that’s known about him is he loves to solicit campaign funds. (Whether it’s a matter of skill or inertia is undetermined.) He has a long callsheet of hundred-millionaire and billionaire buddies. Since Abbott got into state politics in the mid-’90s as a state Supreme Court justice, and later as attorney general on his way to the governor’s mansion, he’s raised roughly half a billion dollars.

Abbott’s warchest, which formally operates as Texans for Greg Abbott, is at this point a political clearinghouse combined with an investment firm. His campaign regularly invests donors’ contributions into U.S. Treasury notes and CDs from banks. (Yes, this is, per the state’s campaign finance laws, legal, so long as the funds are not converted for personal use.) In 2026, Abbott raised about $42 million and purchased more than $30 million in investments—mostly in T-bills. He also earned a return of over $40 million, campaign finance records show. Not bad for a public servant.

Abbott’s warchest eclipses all other political entities’ in Texas—Tim Dunn’s machine, Dan Patrick’s operation, the major PACs like Texans for Lawsuit Reform, and the measly Texas GOP itself. This fundraising prowess has been built on the burgeoning power of his own office—which just two men have held for practically the entire century. His imperial governorship demands tribute from the state’s capitalist class, which he converts into control over the political party that might put any challengers in power.

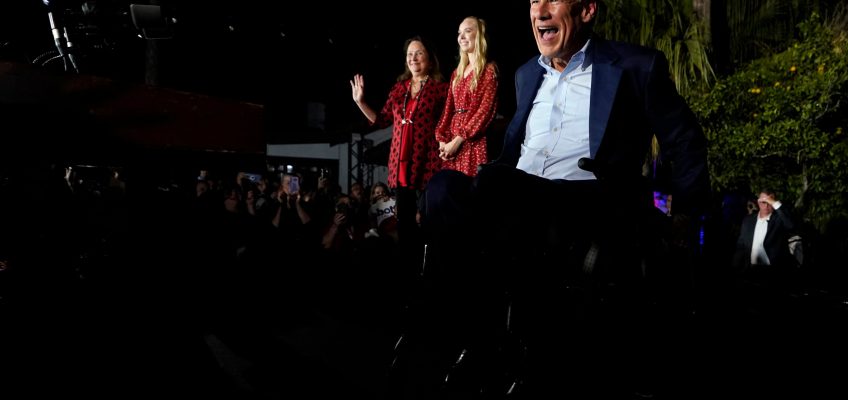

Abbott arrives to speak during a 2022 election night party in McAllen. (AP Photo/David J. Phillip)

The governor’s fortune has obviously protected his own reelections. But increasingly, he’s also wielded that money to expand the realm of his political influence: for instance, using it as a bludgeon to oust GOP legislators at odds with his school voucher agenda; to target any fellow Republican who stands in the way on his vision to “abolish” school property taxes; or to engage in sidequests that—while not a first-order electoral necessity—are more about asserting his dominance and exploiting Dems’ weaknesses.

While Abbott’s campaign team is known for treating every campaign as a do-or-die race, no matter the strength of the opponent, his overflowing coffers also allow him to explore other avenues. Most notably this cycle in Harris County, the largest pillar of Democrats’ state power.

In November, he began teasing his plan to make flipping Harris County his top priority, committing to spend at least $25 million of his campaign cash on the initiative. “I’m going to spend most of [my campaign funds] in Harris County, Texas, to make sure, precinct by precinct, we turn out voters who voted in the presidential election, turn out voters who never voted before,” Abbott said. “We got to win Harris County and make Harris County dark red.”

Abbott has repeatedly singled out Houston and Harris County, now even a greater bête noire than Austin it seems, in the broader legislative fight over state supremacy and local control, and he appears to be accelerating that battle with threats to take over local elections administration from county officials.

Home to one of every six Texans, the county has trended blue in the past two decades and solidified as such in 2016. Abbott narrowly carried it in 2014, but he since lost the county decisively in the past two gubernatorial contests. However, Democrats have suffered declining margins there, to a limited extent in 2022 and to a panic-inducing degree in 2024, while Republicans have poured more and more money into downballot races. In ’24, GOP PACs spent millions to successfully flip key judicial seats, as Dems held on by a hair to the county judgeship and the DA’s office. Kamala Harris carried the county by a mere 5 points.

Abbott’s 2026 goals include ousting all of the seven Democratic state reps who hold office in Harris County. While he certainly won’t topple them all, this sort of grandiose goal has become a hallmark of his campaign strategy—one focused less on winning his own campaigns and more on expanding the Overton window of red Texas. As usual, his longtime political consigliere Dave Carney is the one stirring the cauldron: “We have more than enough voters in Harris County to win,” Carney has projected.

This mirrors similar electoral objectives that Abbott set out for himself ahead of previous reelections. In 2022, he vowed to win more than half of the Hispanic vote in Texas. While he failed in that lofty goal, his machine helped to facilitate electoral shifts in South Texas that have sent Democrats reeling. Exit polling from 2024 showed Donald Trump handily winning the Texas Latino vote.

After Abbott easily swatted away O’Rourke’s ’22 governor bid, when the El Paso Democrat actually was able to compete dollar for dollar, there was a short line of Dem challengers, even in what’s expected to be a blue-wave year, this time around. His likely opponent, Austin state Representative Gina Hinojosa, reported $1.3 million in fundraising since she launched her campaign late last year ($300,000 of that being a loan from herself and her husband).

By comparison, as the Texas Tribune noted, Abbott hauled in more than that from a single donor: Javaid Anwar, a Midland oilman who has quietly become the governor’s largest benefactor. Like many of Abbott’s largest contributors, Anwar is a gubernatorial appointee, in this case to the Texas Higher Education Coordinating Board. He has also, like other big donors, financed private jet travel for the governor and his entourage—in Anwar’s case, covering the travel costs to a UT football game at Ohio State in August.

And Abbott has many more megadonors, who comprise the largest titans of industry in Texas (and, in some cases, other states). More than 40 individuals, couples, or entities have given Governor Abbott $1 million-plus, with several dozen more in the high six figures. For every Javaid Anwar, there are a few Kelcy Warrens, the pipeline mogul who first cut a $1 million check after the devastating winter storm of 2021.

As for Texas Democrats, beyond George Soros and the fickle whims of the national Democratic apparatus, they can’t count on anywhere near that degree of big-money support. In recent cycles, more than enough money has funneled into O’Rourke and Colin Allred in the latter’s 2024 Senate bid—all to no avail. But there’s no warlord like Abbott, secure in his own position, to strategically divvy up the excess patronage. The cash essentially dried up after the ballot’s top slot. The Soros-backed Texas Majority PAC, which is attempting to play a role along these lines, has yet to bear fruit.

Money isn’t everything in politics. But an almost unlimited ability to collect it, paired with the discretion to dispatch it at will, is certainly something Democrats will continue to struggle against—for however many years, or decades, Abbott hangs on to power.

The post More Money than Greg appeared first on The Texas Observer.