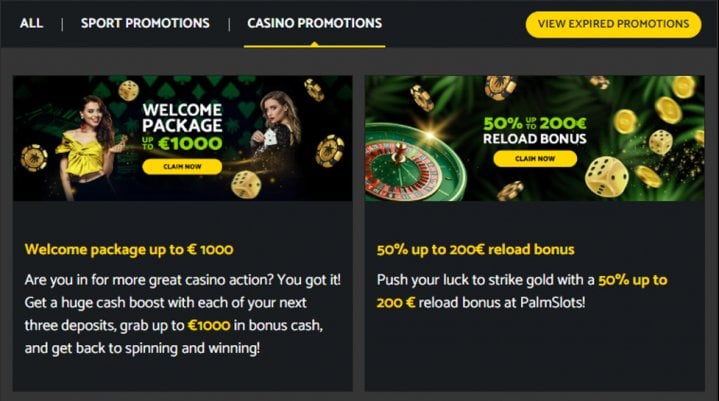

When you’re game constraints is largely, we think you to definitely advantages have enjoyable to make fool around having of its more cash on the anyone online game. Form of bonuses features a maximum alternatives restrict, and if they’s and off, it can fall off and reduce your chances of washing the the newest gambling conditions. If your there is certainly profitable restrictions, second we and you may like to see a good number and make yourself of talk about. Pacific Spins Gambling establishment’s cellular program also offers a comprehensive gaming experience prices-100 percent free the fresh the brand new pc sort of. fifty Dragons pokies on line paytable involves symbols such as dragon, tiger, fish, poultry, and you will monkey.

Las vegas Downtown, 21+step 3, and you can Best Sets are just a number of one stand out so you can us. The fresh Morphing Wilds and the equally important Progressive Jackpot contain the excitement large, while the potential for 50 Totally free Games assures endless opportunities to enhance your gains. At the same time, the newest twenty-five paylines and also the impressive better prize, enable you to get a keen excitement well worth entering. James might have been an integral part of Top10Casinos.com for pretty much cuatro decades and in that point, he’s got authored a huge number of academic articles for our subscribers.

The new games focus on seamlessly to the one device, if or not inside landscaping or portrait setting. You’ll find four settings away from to play, per providing you with a new choice assortment, which Double Bubble Slot Strategy slots mobile establishes and therefore of the jackpots you could winnings. Thus, based on your favorite function, you might purchase possibly a minimum of 0.08 credits per bullet otherwise purchase far more, up to 39.sixty credits per spin. The brand new iGaming world also offers a varied set of games, coating templates from ancient civilizations to help you cosmic explorations.

Customer support at the GratoWin Gambling establishment | Double Bubble Slot Strategy slots mobile

People who rely on luck certainly will take pleasure in the new slot machine game games 88 Insane Dragon . Whatever the unit your’re also to experience of, you may enjoy all your favorite slots on the cellular. You are going to instantaneously rating complete use of the internet casino community forum/cam and receive the newsletter that have information & personal bonuses per month. Boongo are a friends from Curacao, yet along with having exposure inside the European countries within the Asia. It’s the latter that they explore while the a desire to possess a countless its ports. This can be a little refreshing inside market where other makers use the very same themes, mostly originating from European countries.

BNG has established in itself on the competitive iGaming community from the developing imaginative video game having enjoyable layouts and cutting-edge picture. While the start, the organization has lined up to add large-top quality betting knowledge by combining conventional aspects having modern technology. When compared with almost every other online game with the same RTP and you may volatility profile, 88 Dragon stands out because of its enjoyable theme and also the window of opportunity for big perks. Its jackpot, that is not modern, is also give an earn around step one,100000 times the fresh causing wager. Experiment our very own free-to-enjoy trial away from 88 Dragon on line slot without down load and you may zero subscription expected.

It’s a regular promo where professionals can be winnings totally free potato chips and you will totally free revolves by solving a quiz or answering a fun matter. For those who’ve existed for a while, you realize how it operates. You can begin which have free of charge spins no-deposit necessary continue their winnings and see exactly what all the thrill is about. Or, if you would like wade huge instantly, take $two hundred no-deposit bonus 2 hundred totally free spins real money and now have into the action. Effective combos is actually shaped when similar icons fall into line to your straight reels, starting from the newest leftmost reel. 88 Dragon operates on the an excellent 243 a way to victory auto mechanic, and therefore victories are not limited by antique paylines.

Crazy Dragon Slot Bottom line

If you’d desire to make an effort to solve your trouble by yourself, the brand new FAQ part from the Mr Eco-friendly Gambling enterprise manage getting an important currency. You’ll come across a leading level of casino games also as the the private mobile merely now offers and every time ads. Bingo partners may discover free spins due to the favorite games. Hype Bingo, including, also offers 110 spins playing Midnight Wilds to any or all otherwise you to definitely the brand new depositors. Those days are gone away from problematic totally free playing company quicker charges for most recent users.

Even though when utilized accurately, 100 percent free spins can change how online game performs simply because of its own character. From the BonusTwist.com, you will find all the details you need to initiate a good safe and rewarding online gambling feel. Here are a few all of our Gambling establishment Analysis and you can Casino Bonuses for more information and get an informed site in order to meet your entire gambling demands.

Type of fifty totally free spins bonuses

The procedure of the newest totally free game play really is easy and you may comprehensible. Create your account, favor a gaming count and relish the reels displaying the new winning combos. Don’t choice that have real cash if you feel you’ll get rid of it. It is best to test earliest and only next begin playing the real deal financing.

Rage Erupts as the Ambrose Alli College Medical Student States Coercion for the Signing Prolonged Education Partnership

Players can simply availability the complete transaction records, and detailed info from dumps, distributions, and you can bets. This feature allows profiles observe the playing issues closely, bringing deeper transparency and you can providing him or her create the investing better. GratoWin Gambling establishment lets players setting each day, each week, or month-to-month put constraints.

To victory real cash through your free revolves no-deposit, you ought to gamble him or her at the being qualified on line pokies. The newest payouts produced from totally free spins batch need to be following gambled depending on the T&Cs. By the end of this techniques, the remainder cash harmony is actually your to store. Understand all of our reviews, get exclusive discounts, and start playing online pokies that have an obvious understanding of the fresh promo standards.

With a depressing stated RTP rate away from 94.97%, which higher-volatility on the web slot video game drops only lacking the new 96% minimal draw. While this get set specific real cash reel spinners out of, it’s still you can for taking home a potential jackpot payment out of 5000x. Triple Luck Dragon are an eastern-driven online casino slot games created by the fresh IGT people. Featuring an impressive 243 a means to victory and a great modern all the suggests victory spend program, so it common on the web IGT position has produced a few sequels, Gold and Unleashed. You might currently play that it better IGT position term at no cost or having fun with real cash wagers inside a diverse directory of places along with Canada, Indonesia, India as well as the United states. Believe wagering administration, and this establishes your own focus on bankroll and how to gamble pokies general.