Crossover star Josh Groban will return to St. Paul’s Grand Casino Arena on June 28 with support from EGOT winner Jennifer Hudson. It’ll be his first performance in the metro in nearly eight years.

Tickets go on sale at 10 a.m. Friday through Ticketmaster. Citi cardholders and Verizon customers have access to a presale that runs through 10 p.m. Thursday.

Los Angeles native Groban has sold more than 25 million albums and is a favorite on daytime talk shows (he sat in with Oprah six times and announced his upcoming tour on Hudson’s show) thanks to his easy-going demeanor and even easier-going songs. His light-rock radio hits include “To Where You Are,” “Believe,” “Awake,” “Brave,” “Celebrate Me Home” and the now-ubiquitous “You Raise Me Up.”

In 2023, Groban returned to Broadway for his second time in the title role in a revival of Stephen Sondheim’s musical “Sweeney Todd: The Demon Barber of Fleet Street.” In May, he performed a residency at Caesars Palace in Las Vegas.

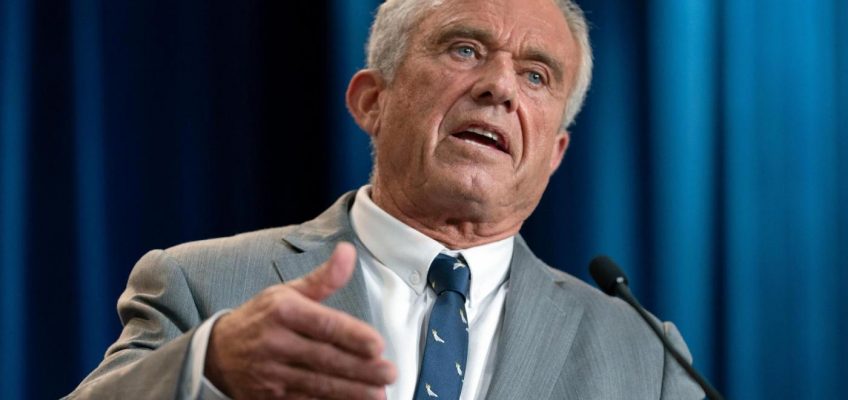

Jennifer Hudson

Related Articles

Snoop Dogg will perform on Christmas Day when Vikings host Lions

SPCO shines with its seasonal presentation of ‘Brandenburg’ Concertos

Headliners announced for third annual Minnesota Yacht Club Festival

Rod Stewart to play the Grandstand in what’s likely his final local concert

Goo Goo Dolls, Toto/Christopher Cross and Avenged Sevenfold to play Shakopee amphitheater

Hudson emerged in 2004 as a finalist in the third season of “American Idol.” While she only placed seventh, she became one of the most successful graduates of the show.

She earned EGOT status by winning an Emmy in 2021 for her role as a producer on the interactive fairy tale story “Baba Yaga,” a Grammy for her 2008 self-titled debut album, an Oscar for her film debut playing Effie White in the 2006 film adaptation of “Dreamgirls” and a Tony as a producer of 2022’s “A Strange Loop.” With the latter, she became the youngest woman and the third Black recipient of all four awards.

Hudson has hosted the syndicated daytime talk show “The Jennifer Hudson Show” since 2022.