By MICHAEL MELIA, Associated Press

It was one of the year’s biggest stories — the selection of the first American pope — and an Associated Press journalist was interviewing the pope’s brother at his home in suburban Chicago. Suddenly, they heard a ringing coming from the basement. “That might be the pope,” the new pontiff’s brother said.

Indeed, the man who had emerged hours earlier on the balcony of St. Peter’s Basilica as Pope Leo XIV was calling to catch up with his older brother. Obed Lamy, a video journalist, listened and recorded as the conversation played out on speaker.

“I was shaking because I didn’t know what the pope would say,” Lamy said. “Am I supposed to say something or not say anything?”

In a year marked by political strife, natural disasters and other calamities around the world, 2025 also had its share of uplifting moments. AP journalists were in the middle of many of them.

Some found stories of joy amid disaster, including a wedding in a typhoon-flooded church in the Philippines and a youth theater group that staged a production weeks after a devastating wildfire in California. Some became part of the stories they were covering, simply by being there. In Seattle, an AP photographer broke the news to a scientist that she had won a Nobel Prize.

Here are their stories.

Related Articles

Today in History: December 17, Black motorcyclist beaten to death after leading police chase

The US labels another Latin American cartel a terrorist group as the anti-drug war escalates

FIFA slashes price of some World Cup tickets to $60 after global fan backlash

A photographer finds thousands of dinosaur footprints near Italian Winter Olympic venue

After a year of Trump, EU leaders begrudgingly learn to live with the reality of an unreliable ally

The pope was on the line

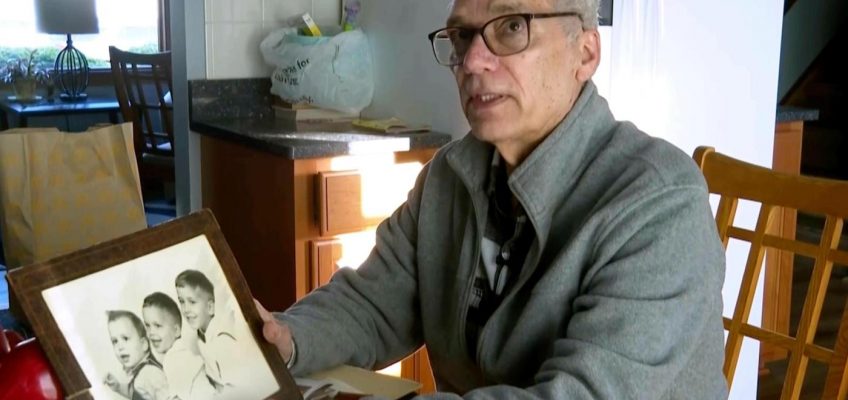

Lamy, a video journalist, was among many reporters who went to the home of John Prevost in New Lenox, Illinois, after his brother became the pope.

I had arrived at Prevost’s home in the early evening after driving three hours from Indianapolis, where I am based. After walking by other media outside, I knocked on the door. Prevost let me in.

As we talked, a ringing came from the basement. Prevost hurried to a tablet downstairs and I followed, my camera on. He found he had a few missed calls from his brother. He called the pope back, using a speaker to play the audio out loud. The pope picked up.

I got the shot — the new pontiff’s voice speaking to his older brother, asking him why he hadn’t been answering his calls.

“Well, first you need to know you’re on the air right now,” the older brother responded. “This is the first time I’m hearing that this thing rang.”

The conversation went on for just a few minutes. They talked like any other pair of siblings. He told the pope, “Oh, we’re coming to Rome.” And the pope said, “Oh, where are you going to sleep?” It was interesting the pope himself did not know what the accommodations for his family would look like.

Breaking the news to a Nobel winner

When the Nobel Prize in medicine was announced, photographer Lindsey Wasson was dispatched before dawn to the home of Mary E. Brunkow, a scientist in North Seattle. Wasson broke word of the honor before the Nobel committee could reach Brunkow.

When I arrived, I wasn’t completely sure I was at the right house because my GPS had taken me to the back. After walking through a neighbor’s pitch-black driveway, I arrived at the front door. It was clear nobody was awake.

Thankfully, when I knocked, their dog barked and woke Mary’s husband, Ross, who spoke to me through the glass door. I identified myself and asked if a Mary lived there and if he knew why I was there. Not wanting to spoil it but seeing no other way in, I told him, “Sir, your wife just won the Nobel Prize.”

FILE – Mary E. Brunkow speaks on the phone during an interview after winning a Nobel Prize in medicine for part of her work on peripheral immune tolerance, in Seattle, Oct. 6, 2025, next to her is her dog Zelda. (AP Photo/Lindsey Wasson, File)

Thankfully, he let me in, and I took a quick frame as he brought Mary to the kitchen while telling her the news. They were still in disbelief, so I handed my phone to Ross with our initial AP story, which he read aloud in part to Mary.

The initial mood, very understandably, was a mix of tension, annoyance and disbelief at being woken up at 3:45 a.m. Ross told me that when he first went into their bedroom with the news, she said, “Don’t be ridiculous.” As soon as Mary and Ross began to process the news and realized all those missed calls from Sweden overnight weren’t spam, the mood shifted to one of joy.

I was able to follow along with my camera as Mary sifted through an avalanche of emails, text messages and phone calls from family, friends and other journalists hoping to speak with her.

Capturing a wedding that went on despite typhoon flooding

Photographer Aaron Favila has covered floods for years in the Philippines, which sees at least 20 typhoons a year. He raced to cover a wedding at a flooded church just north of Manila after getting a tip from a photographer colleague.

I had an hour window to make it to the venue and had to drive out of town and cross several flooded roads during a heavy downpour. The flooding in the area was too deep for our vehicle, so we had to stop. Luckily, a rescue truck passed by, and I rode that.

I got there right before they opened the door for the bride.

FILE – Newlyweds Jade Rick Verdillo, right, and Jamaica kiss during their wedding inside a flooded Barasoain church in Malolos, Philippines, July 22, 2025. (AP Photo/Aaron Favila, File)

The groom, Jade Rick Verdillo, told me they were eager to go ahead with the ceremony despite the floodwaters. “We’ve been through a lot. This is just one of the struggles that we’ve overcome,” he said.

If I was shooting for a deadline story, I would have run out after the first kiss. But for this one, I stuck till the end to make sure I captured every moment … just like a wedding photographer.

A youth theater production rises from wildfire ashes

Reporter Jocelyn Gecker covered opening night of a Southern California youth theater group after the Palisades wildfire destroyed their theater and many cast members’ homes.

Rehearsals for the group’s upcoming musical, “Crazy for You,” had started on Jan. 6. The next day, the Palisades Fire ripped through their community. But the show would go on, said director Lara Ganz, whose family also lost their home. It was about restoring togetherness, hope and routine and showing the kids who had lost so much that life was not over.

Witnessing opening night was a gift. It was an evening of such intense emotions jumbled together: joy and pain, heartbreak and happiness, grief and pride. It was a light in the darkness, as one father told me.

FILE – Callum Ganz, 17, center, gives a pre-show pep talk to castmates in Crazy for You on opening night as the Theatre Palisades Youth group returns to the stage after losing their theater in the Palisades fire, in Los Angeles, Feb. 28, 2025. (AP Photo/Jocelyn Gecker, File)

One teen said when he sang and danced to the music of George and Ira Gershwin, the weight of his loss lifted. He only felt happiness.

After the article was published, Ganz relayed that members of the Gershwin family trust had read the story and attended a later performance. They delivered a letter to the cast and crew.

“On behalf of the families of George and Ira Gershwin, we applaud your resilience,” the letter said. It praised their “amazing dedication” in the face of hardship and said they hoped the cast was immensely proud of their production. “We know that George and Ira would be too.”