By SUSAN MONTOYA BRYAN and DORANY PINEDA, Associated Press

The Trump administration is expanding its crackdown on diversity, equity and inclusion by ordering national parks to purge their gift shops of items it deems objectionable.

The Interior Department said in a memo last month that gift shops, bookstores and concession stands have until Dec. 19 to empty their shelves of retail items that run afoul of President Donald Trump’s agenda.

Related Articles

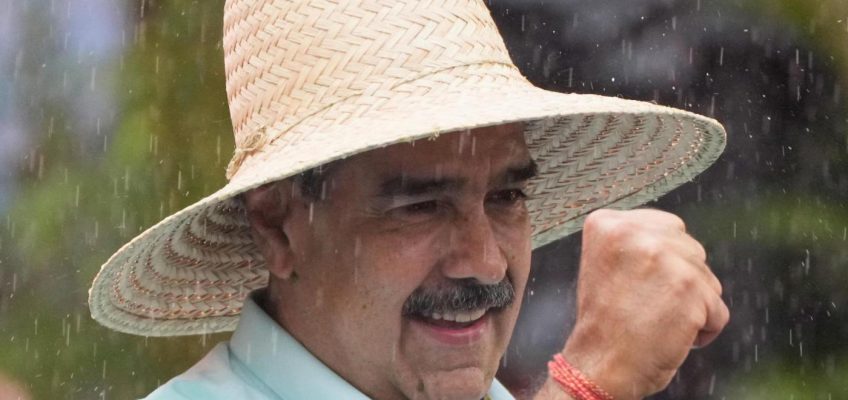

US sanctions Venezuelan President Maduro’s 3 nephews as pressure campaign ratchets up

The Senate voted down dueling health proposals. Here’s what’s at stake for Americans

Treasury Secretary Bessent calls for looser regulations for the US financial system

Noem links the seizure of an oil tanker off Venezuela to US antidrug efforts

Senators seek to change bill that allows military to operate just like before the DC plane crash

The agency said its goal is to create “neutral spaces that serve all visitors.” It’s part of a broader initiative the Trump administration has pursued over the last year to root out policies and programs it says discriminate against people based on race, gender and sexual orientation — an effort that has led some major corporations and prominent universities to roll back diversity programs.

Conservation groups say the gift shop initiative amounts to censorship and undermines the National Park Service’s educational mission. But conservative think tanks say taxpayer-funded spaces shouldn’t be allowed to advance ideologies they say are divisive.

Employees of the park service and groups that manage national park gift shops say it’s not clear what items will be banned. They didn’t want to speak on the record for fear of retribution.

Items for sale are on display at the museum store at Independence National Historical Park, Tuesday, Dec. 9, 2025, in Philadelphia. (AP Photo/Matt Slocum)

A debate over what’s acceptable for park gift shops

“Our goal is to keep National Parks focused on their core mission: preserving natural and cultural resources for the benefit of all Americans,” the Interior Department said in a statement. The agency said it wants to ensure parks’ gift shops “do not promote specific viewpoints.”

Alan Spears, the senior director for cultural resources at the National Parks Conservation Association, said removing history books and other merchandise from gift shops amounts to “silencing science and hiding history,” and does not serve the interests of park visitors.

Other groups called the review of gift shops a waste of resources at a time of staffing shortages, maintenance backlogs and budget issues.

Stefan Padfield, a former law professor who now works with a conservative think tank in Washington, said there is no way to defend the government’s promotion of “radical and divisive” ideologies through the sale of books and other items, though he said the challenge for the Trump administration will be in deciding what is acceptable and what isn’t.

“Now, are there going to be instances of the correction overshooting? Are there going to be difficult line-drawing exercises in gray areas? Absolutely,” said Padfield, the executive director of the Free Enterprise Project at the National Center for Public Policy Research.

Keisha Burse looks at items for sale at Martin Luther King Jr. National Historical Park, Tuesday, Dec. 9, 2025, in Atlanta. (AP Photo/Megan Varner)

The order is open to interpretation

All items for sale at parks and online are supposed to be reviewed for neutrality. That includes books, T-shirts, keychains, magnets, patches and even pens.

But the memo issued by a senior Interior Department official didn’t give any examples of items that could no longer be sold, leaving the order open to interpretation. No training sessions have been offered to park service employees.

Some parks had already completed their reviews, finding nothing to add to the list.

On display this week at Independence National Historical Park in Philadelphia were items featuring Frederick Douglass. At the Martin Luther King, Jr. National Historical Park store in Atlanta, there were various books on the Civil Rights Movement and a book for children about important Black women in U.S. history. For sale online was a metal token for the Belmont-Paul Women’s Equality National Monument.

There already is a thorough process for vendors to get merchandise into national park stores. Items are vetted for their educational value and to ensure they align with the themes of the park or historical site.

Items for sale are displayed at Martin Luther King Jr. National Historical Park, Tuesday, Dec. 9, 2025, in Atlanta. (AP Photo/Megan Varner)

National parks in the spotlight

The park service in recent weeks faced criticism when it stopped offering free admission to visitors on Martin Luther King Jr. Day and Juneteenth, while extending the benefit to U.S. residents on Flag Day, which also happens to be Trump’s birthday next year.

Earlier this year, the Interior Department’s ordered parks to flag signs, exhibits and other materials it said disparaged Americans. That order sparked debate about books related to Native American history and a photograph at a Georgia park that showed the scars of a formerly enslaved man.

In one of his executive orders, Trump said the nation’s history was being unfairly recast through a negative lens. Instead, he wants to focus on the positive aspects of America’s achievements, along with the beauty and grandeur of its landscape.

Mikah Meyer knows that beauty well after a three-year road trip to visit all 419 national park sites. He said part of the mission of his travels, which he shared on social media and in a documentary, was to illustrate that parks are welcoming to the LGBTQ+ community.

That message aligns with his business, Outside Safe Space, which at its peak was selling stickers and pins featuring a tree with triangle-shaped, rainbow-colored branches to more than 20 associations that operated multiple park stores. His items started to be pulled from some stores after the executive orders were issued earlier this year.

“How is banning these items supporting freedom of speech?” Meyer said.

Keisha Burse looks at items for sale at Martin Luther King Jr. National Historical Park, Tuesday, Dec. 9, 2025, in Atlanta. (AP Photo/Megan Varner)