By MATT O’BRIEN

MOUNTAIN VIEW, Calif. (AP) — Robots have long been seen as a bad bet for Silicon Valley investors — too complicated, capital-intensive and “boring, honestly,” says venture capitalist Modar Alaoui.

But the commercial boom in artificial intelligence has lit a spark under long-simmering visions to build humanoid robots that can move their mechanical bodies like humans and do things that people do.

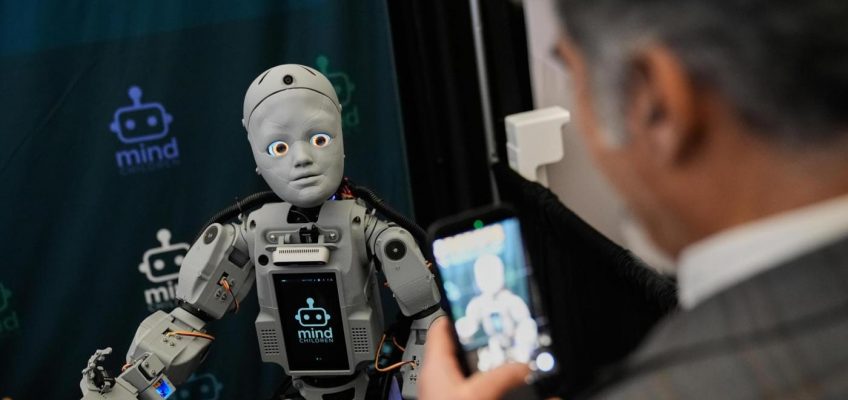

Alaoui, founder of the Humanoids Summit, gathered more than 2,000 people this week, including top robotics engineers from Disney, Google and dozens of startups, to showcase their technology and debate what it will take to accelerate a nascent industry.

Alaoui says many researchers now believe humanoids or some other kind of physical embodiment of AI are “going to become the norm.”

“The question is really just how long it will take,” he said.

Disney’s contribution to the field, a walking robotic version of “Frozen” character Olaf, will be roaming on its own through Disneyland theme parks in Hong Kong and Paris early next year. Entertaining and highly complex robots that resemble a human — or a snowman — are already here, but the timeline for “general purpose” robots that are a productive member of a workplace or household is farther away.

Even at a conference designed to build enthusiasm for the technology, held at a Computer History Museum that’s a temple to Silicon Valley’s previous breakthroughs, skepticism remained high that truly humanlike robots will take root anytime soon.

“The humanoid space has a very, very big hill to climb,” said Cosima du Pasquier, founder and CEO of Haptica Robotics, which works to give robots a sense of touch. “There’s a lot of research that still needs to be solved.”

The Stanford University postdoctoral researcher came to the conference in Mountain View, California, just a week after incorporating her startup.

“The first customers are really the people here,” she said.

Researchers at the consultancy McKinsey & Company have counted about 50 companies around the world that have raised at least $100 million to develop humanoids, led by about 20 in China and 15 in North America.

China is leading in part due to government incentives for component production and robot adoption and a mandate last year “to have a humanoid ecosystem established by 2025,” said McKinsey partner Ani Kelkar. Displays by Chinse firms dominated the expo section of this week’s summit, held Thursday and Friday. The conference’s most prevalent humanoids were those made by China’s Unitree, in part because researchers in the U.S. buy the relatively cheap model to test their own software.

In the U.S., the advent of generative AI chatbots like OpenAI’s ChatGPT and Google’s Gemini has jolted the decades-old robotics industry in different ways. Investor excitement has poured money into ambitious startups aiming to build hardware that will bring a physical presence to the latest AI.

But it’s not just crossover hype — the same technical advances that made AI chatbots so good at language have played a role in teaching robots how to get better at performing tasks. Paired with computer vision, robots powered by “visual-language” models are trained to learn about their surroundings.

One of the most prominent skeptics is robotics pioneer Rodney Brooks, a co-founder of Roomba vacuum maker iRobot who wrote in September that “today’s humanoid robots will not learn how to be dexterous despite the hundreds of millions, or perhaps many billions of dollars, being donated by VCs and major tech companies to pay for their training.” Brooks didn’t attend but his essay was frequently mentioned.

Also missing was anyone speaking for Tesla CEO Elon Musk’s development of a humanoid called Optimus, a project that the billionaire is designing to be “extremely capable” and sold in high volumes. Musk said three years ago that people can probably buy an Optimus “within three to five years.”

The conference’s organizer, Alaoui, founder and general partner of ALM Ventures, previously worked on driver attention systems for the automotive industry and sees parallels between humanoids and the early years of self-driving cars.

Near the entrance to the summit venue, just blocks from Google’s headquarters, is a museum exhibit showing Google’s bubble-shaped 2014 prototype of a self-driving car. Eleven years later, robotaxis operated by Google affiliate Waymo are constantly plying the streets nearby.

Some robots with human elements are already being tested in workplaces. Oregon-based Agility Robotics announced shortly before the conference that it is bringing its tote-carrying warehouse robot Digit to a Texas distribution facility run by Mercado Libre, the Latin American e-commerce giant. Much like the Olaf robot, it has inverted legs that are more birdlike than human.

Industrial robots performing single tasks are already commonplace in car assembly and other manufacturing. They work with a level of speed and precision that’s difficult for today’s humanoids — or humans themselves — to match.

The head of a robotics trade group founded in 1974 is now lobbying the U.S. government to develop a stronger national strategy to advance the development of homegrown robots, be they humanoids or otherwise.

“We have a lot of strong technology, we have the AI expertise here in the U.S.,” said Jeff Burnstein, president of the Association for Advancing Automation, after touring the expo. “So I think it remains to be seen who is the ultimate leader in this. But right now, China has certainly a lot more momentum on humanoids.”

Associated Press journalist Terry Chea contributed to this report.