By DANICA KIRKA

LONDON (AP) — The U.K. Parliament on Tuesday will debate calls for greater accountability from a member of the royal family as the arrest of the former Prince Andrew and his links to convicted sex offender Jeffrey Epstein force British society to re-examine its deference to the monarchy.

Lawmakers will confront the issue when they consider a motion calling for the release of confidential documents related to Andrew’s appointment as Britain’s special envoy for international trade in 2001.

Related Articles

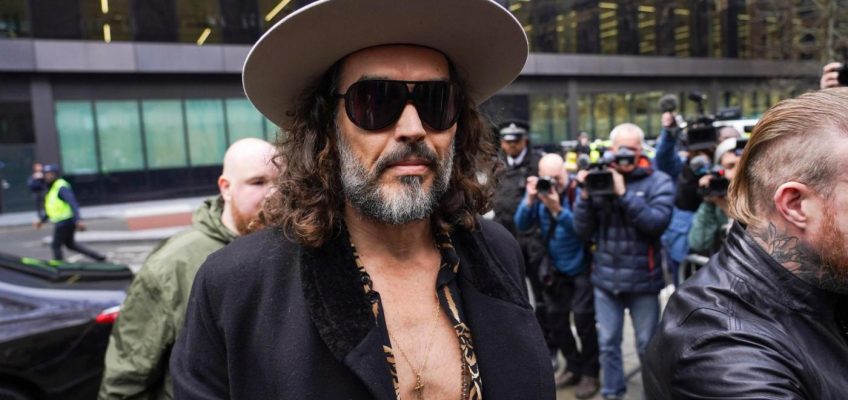

British comedian Russell Brand pleads not guilty to new rape and sexual assault charges

Today in History: February 24, Jerry Falwell loses to Larry Flynt at the Supreme Court

US sheds light on its allegation of Chinese nuclear test and urges nations to push for disarmament

Students in Iran hold anti-government protests as US forces gather for possible strikes

France moves to bar US Ambassador Charles Kushner from direct government access

King Charles III’s younger brother, who was stripped of his princely title last year due to revelations about his relationship with Epstein, was arrested last week on suspicion of misconduct in public office amid allegations that he shared confidential documents with Epstein during his time as trade envoy. Andrew Mountbatten-Windsor, as he is now known, was released without charge and the investigation continues.

A history of deference

Tuesday’s debate marks a departure for the House of Commons, where the rules of the house have historically prohibited members of Parliament from criticizing members of the royal family. Ed Davey, the leader of the Liberal Democrats and the lawmaker who introduced the motion, wants to change that.

“One thing the Liberal Democrats stand for is to hold the powerful to account,” Davey told the BBC. “And I think we’ve seen too often in the past that people, because of their title or their friend or whatever, have not been properly held to account.”

The debate comes as the U.S. Justice Department’s release of millions of pages of documents related to Epstein exposes how the wealthy financier used an international web of rich, powerful friends to gain influence and sexually exploit young women. Nowhere has the fallout been felt more strongly than in the U.K., where the scandal has raised questions about the way power is wielded by the aristocracy, senior politicians and influential businessmen, known collectively as “the Establishment.”

Investigations continue

British police on Monday arrested Peter Mandelson, a one-time government minister who later served as ambassador to the United States, on suspicion of misconduct in public office related to allegations that he, too, shared confidential information with Epstein. Mandelson was released early Tuesday morning after more than nine hours of questioning. He hasn’t been charged, and the investigation is continuing.

While they haven’t spoken publicly about the investigations, both Mountbatten-Windsor and Mandelson have previously denied any wrongdoing. Epstein died in custody in 2019 while awaiting trial on sex trafficking charges.

For the House of Windsor, Tuesday’s debate is a reflection of a crisis that shows no sign of abating.

Buckingham Palace has tried to insulate the monarchy from the scandal, drawing a clear bold line between Mountbatten-Windsor and the rest of the royal family. In addition to removing his royal titles, Charles forced his brother to move out of the 30-room estate near Windsor Castle where he had lived rent free for more than 20 years.

But that may not be enough to quell the voices demanding change. The loudest of those comes from the campaign group Republic, which has long called for the monarchy to be replaced by an elected head of state.

Soft power, and a lot of it

While the U.K.’s constitutional monarchy no longer wields political power, it remains hugely influential at the apex of British society. The king is a symbol of continuity who serves as head of state for Britain and 14 other independent countries with ties to the former British Empire. Working members of the royal family support him by making hundreds of public appearances each year, visiting charities, military bases and community groups that still clamor for their attention.

Commentators have compared the pressures facing the House of Windsor to 1936, when King Edward VIII abdicated the thrown to marry the American divorcee Wallis Simpson.

“Unlike the last significant family crisis of the modern monarchy, the abdication of 1936, this is not an immediate matter of constitutional crisis, yet its implications may well prove more significant for the monarchy, and so they should,’’ royal historian Anna Whitelock wrote this week in the Sunday Times newspaper. “It is the last of our public institutions to face the full glare of public scrutiny, with questions raised about its role, purpose, governance, financing and accountability.’’