By DAVID BAUDER, AP Media Writer

During Kamala Harris’ thrill ride that has upended the 2024 presidential campaign, journalists for the most part have been on the outside looking in. The vice president hasn’t given an interview and has barely engaged with reporters since becoming the Democratic choice to replace Joe Biden.

That’s about to change, now that it has become a campaign issue. But for journalists, the larger lesson is that their role as presidential gatekeepers is probably diminishing forever.

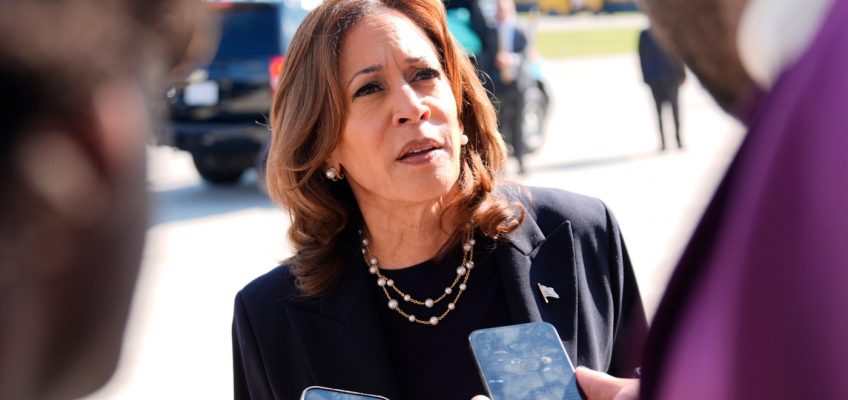

Harris travels with reporters on Air Force Two and frequently talks to them, but her campaign staff insists the conversations are off the record. Outside of the plane on Thursday, she approached cameras and notebooks to publicly answer some questions, and one of them was about when she would sit down for an in-depth interview.

“I’ve talked to my team,” she said. “I want us to get an interview together by the end of the month.”

She spoke on the same afternoon that her Republican opponent, former President Donald Trump, gave a news conference at his Mar-a-Lago resort, in part to draw a contrast with Harris. “She’s not smart enough to do a news conference,” Trump said. His vice presidential candidate, JD Vance, posted a comment on social media to point out that Trump was doing something that Harris hadn’t.

The landscape for candidate interviews has changed

Given that modern presidential campaigns are essentially marketing operations, Harris’ stance is not surprising. For the teams behind candidates, “the goal is to control the message as much as possible,” said Kevin Madden, a Republican communications strategist who was senior adviser to Mitt Romney’s campaigns in 2008 and 2012.

Related Articles

Microsoft says Iranian hackers targeted US political campaigns

‘Our lives are on the line’: Why many LGBTQ+ people hope for a Harris win

Trump wants presidents to have some say over interest rates

Tim Walz’s net worth trails the other candidates

Candidates for Ramsey, Washington, Dakota county board seats square off in Tuesday’s primary

Interviews and news conferences take that control away. Candidates are at the mercy of questions that journalists raise — even if they try to change the subject. News outlets decide which answers are newsworthy and will be sliced and diced into soundbites that rocket around social networks, frequently devoid of the context in which they were uttered.

In such an environment, the value and perception of the sit-down interview has changed — for journalists and candidates alike.

When Trump appeared last month in an interview format before the National Association of Black Journalists, his aides almost certainly didn’t want the main headline to be about their candidate suggesting Harris had misled voters about her race.

Between Instagram, Tik-Tok, televised rallies, emails or texts, campaigns have so many other ways of getting their message across to potential voters today. This lessens the need to directly engage with journalists, Madden said.

“Presidential campaigns increasingly are conducted as performances before a sympathetic audience, one that is invited to watch and listen but not to question or respond,” The New York Times wrote in a recent editorial.

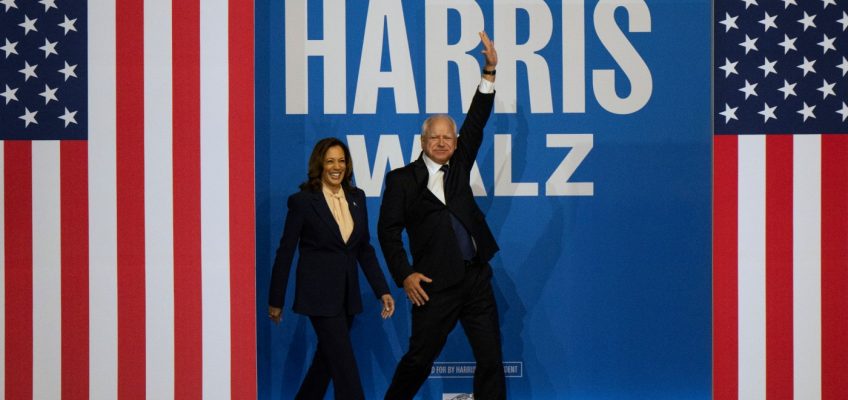

Harris’ unusual late entry into the race means she bypassed vetting by voters, with journalists often as their surrogates, that takes on a more important role in the early stages of a nomination fight where a more intimate form of retail politics varies from state to state. That makes it all the more important that she be available to speak about her record and plans, the newspaper argued.

“Americans deserve the opportunity to ask questions of those who are seeking to lead their government,” the editorial said.

The Times’ editorial board has requested an interview with Harris and hasn’t received an answer, a spokesman said. The same was true of Biden before he dropped out.

A sympathetic interview — or none at all

Harris and her team may be taking lessons from her boss; Biden has lagged behind previous presidents in the number of interviews granted and press conferences held. That changed after the June debate with Trump that sent his re-election effort into a death spiral; televised interviews with ABC’s George Stephanopoulos and NBC’s Lester Holt did little to change that trajectory.

Trump has been more available, but often he talks with people unlikely to challenge him. Since July 5, he’s given interviews to Fox News personalities Maria Bartiromo, Laura Ingraham, Jesse Watters, Harris Faulkner, Brian Kilmeade and Sean Hannity. He’s also appeared twice on the “Fox & Friends” morning show.

Between those interviews — frequently clipped and run on other networks — and an endless stream of posts on his Truth Social site, Trump is “a content machine,” Madden said.

Trump’s news conference was telecast live on CNN, Fox News Channel and MSNBC, although CNN and MSNBC both cut out before it was finished to fact check some of the claims.

Fox has also frequently pointed out the issue of Harris’ lack of access. “Trump Takes Questions as Harris Dodges Media,” said one of the network’s onscreen messages as Trump talked.

“We can’t be the only media company that talks about it,” Fox’s Bill Hemmer said on Tuesday, making reference to the upcoming Democratic national convention. “Sixteen days she has gone without a significant interview. Is it possible that she could run out the clock until Chicago? That would be extraordinary. then you’d have to ask yourself. What are you hiding? What is your team hiding from?”

Madden said that while interviews carry less importance than they used to, there are still some undecided voters who want to see them to help make their choices. That’s why he expects they will happen.

“You want to control it as long as possible as much as possible,” he said. “They have had so much momentum over the last couple of weeks, they haven’t had to really sit down and make their case directly to reporters yet. The day is surely coming.”

___

Associated Press reporters Seung Min Kim and Will Weissert in Washington and Darlene Superville in Romulus, Michigan, contributed to this report. David Bauder writes about media for the AP. Follow him at http://twitter.com/dbauder.