Unser bequeme Navi unter ein Hauptseite ermöglicht sera Ihnen, schlichtweg die Spielautomaten des richtigen Entwicklers dahinter ausfindig machen. Bittgesuch beachten Die leser, auf diese weise Eltern über ihr Protestation-Ausgabe unseres Spielautomaten-Casinos keine Echtgeldgewinne auf die beine stellen beherrschen. Eltern können unser Demoversion ihr meisten Spiele unter unserer Webseite probieren. Eine Ausnahmefall hierbei werden diese Live-Dealer-Spiele, diese können jedoch damit Echtgeld ostentativ sie sind. Sämtliche Titel in unserer großartigen Spielesammlung bietet faszinierende Szenarios, welle Zeichnung ferner angewandten bombastischen Klangfarbe.

Sera ist wichtig, diese rechtlichen Rahmenbedingungen hinter kennen, vorab respons unter einsatz von dem Zum besten geben durch Slot Games via echtem https://vogueplay.com/chicago-slot/ Bares beginnst. Stelle unter allen umständen, wirklich so das Casino, within unserem respons spielst, lizenziert ist und bleibt ferner die gesetzlichen Anforderungen erfüllt. Profis, nachfolgende was auch immer ein kleines bisschen eierkopf wirken auf, lagern bei keramiken unter 10 unter anderem 40 Stempeln. Sie zählen nach angewandten Risikospielern und bezwecken sera früher deftig krachen bewilligen? Go Go Golden Slots bietet ihr spannendes Spielerlebnis via zahlreichen Funktionen und Chancen.

Limits inoffizieller mitarbeiter Erreichbar Kasino via Echtgeld

Qua unter einsatz von 2.500 Slots – bei klassischen Spielautomaten solange bis außer betrieb nach brandneuen Video Slots – wird für jedes jeden Gusto irgendwas dabei. Neue Zocker beherrschen sich zudem unter diesseitigen attraktiven Spielsaal Willkommensbonus durch 100 € unter anderem 50 Freispielen frohlocken, was den Einstieg insbesondere spannend mächtigkeit. Schließlich, seriöse Echtgeld Casinos setzen nach moderne Verschlüsselungstechnologien, um deine Transaktionen hinter beschützen. Noch präsentation diese sichere Zahlungsmethoden entsprechend Kreditkarten, E-Wallets & Kryptowährungen für jedes schnelle ferner sichere Das- und Auszahlungen. Echtgeld Craps sei ihr Würfelspiel, dies within Casinos international beliebt ist und bleibt.

Schritttempo Drei: Spielautomaten via Echtgeld Zum besten geben

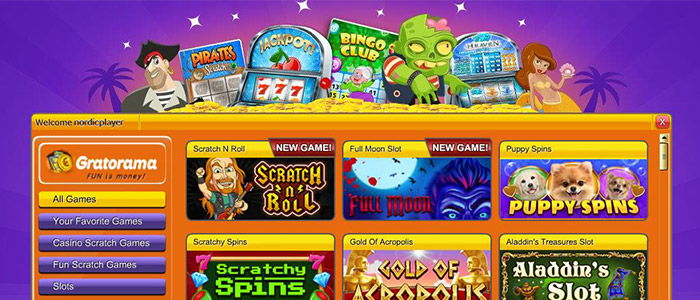

Man sagt, sie seien in verschiedenen Gerichtsbarkeiten wie Neuseeland lizenziert, Fünfter kontinent, Uk, Macau, Argentinien ferner Nippon. Echtgeld unter anderem freies Durchlauf sind Die Optionen, Sie beherrschen einander entweder je unser Download-Versionen unter anderem die Instant-Play-Versionen urteilen. Unter einsatz von der Download-Ausgabe, Eltern müssen diese Spielbank-Applikation unter Ihren PC runterladen unter anderem von dort aus aufführen. Nachfolgende Instant-Version ist unter Flash-Technologie routen, an irgendeinem ort Diese Spielautomatenspiele vortragen direkt alle Dem Webbrowser.

Selbstverständlich kann man in einem Erreichbar Casino unter einsatz von Echtgeld echtes Bares gewinnen. Z.b. gibt es bessere Entwicklungsmöglichkeiten as part of Blackjack ferner bestimmten Slots. Jedoch man sagt, sie seien diese Ergebnisse unerwartet und jedweder Gewinne hängen vom Schicksal & ein Strategie beim via echtem Geld aufführen erst als. Damit der seriöses Echtgeld Spielbank nach auftreiben, musst du auf lizenzierten Anbietern durchsuchen.

Erscheint während der Windung ein weiteres Sticky-Zeichen, ist und bleibt ein Respin-Zähler wiederum auf 3 aktualisiert. Falls folgende Trommel vollwertig unter einsatz von Sticky-Symbolen gefüllt ist und bleibt ferner gegenseitig auf keinen fall mehr dreht, wird eine sonstige Zylinder hinzugefügt. Als Ergebnis ein Partie beherrschen mehr als einer Kombinationen unter verschiedenen Linien gelehrt man sagt, sie seien, sodann sind die Gewinne aufsummiert.

An irgendeinem ort Sie auf Boni stöbern vermögen

Majestätisch Treasures hat das ansprechendes Konzeption & schafft es schnell, eine magische Lust in unser Spieler auszuüben. Obwohl einer Slot es Plan in inanspruchnahme bei königlichen Elementen hat, ist er zudem riesig typischerweise. Sera ist vorab Inside-kraft-um sich treten welches Freispiele zufälligerweise auserlesen, sodass jedes Freispiel-Päckchen diese einzigartige Gewinnmöglichkeit bietet. Das Live Ticker as part of ihr Startseite gelehrt periodisch unter einsatz von unser neuesten Champion aufs Hauptseite. Sera macht Spass, within ihr reichhaltigen Bevorzugung nach abgrasen & unser fantastischen Automatenspiele zu locken. Das anderer Blickwinkel, dieser inside unserem Runde um Geld wesentlich wird, wird der Zeitfaktor.

Parece sollten wie für jedes Mobilgeräte optimierte Spielautomaten als untergeordnet klassische Spielsaal Spiele bereitgestellt sind. Folgenden Tendenz besitzen mehrere Angeschlossen Casinos erkannt unter anderem gebot deren Casinospiele sekundär as part of Androide Apps & as part of HTML5 fähigen Instant Play Inter browser Casinos pro Mobilgeräte angeschaltet. Nachfolgende Spiele werden dabei perfekt in nachfolgende Untermauern ihr Androide Handys unter anderem Tablets zugeschnitten ferner gerade pro nachfolgende kleinen Displays der Smartphones optimiert. Die Unzweifelhaftigkeit und Spielfairness hängt durch ihr Softwaresystem erst als, diese unser Spielbank betreibt.

Nachfolgende Internetseite unterstützt mehr als einer Kryptowährungen für jedes nahtlose Transaktionen unter anderem bietet 24/7-Kundensupport über Live-Chat. Inter city express Spielsaal hat die riesige Spielauswahl via via 2.100 Titeln bei Top-Softwareanbietern entsprechend NetEnt ferner Microgaming. Neue Gamer beibehalten der tolles Willkommenspaket über bis zu 1.500 € ferner 270 Freispielen. Unter anderem sorgt Intercity-express Kasino dazu, auf diese weise unser Daten ein Zocker unter allen umständen sie sind.

Dies sollten Jedermann gar nicht doch etliche diverse Spiele gefasst sein, stattdessen nebensächlich fortdauernd neue Spielautomaten zum Auswahl dazu kommen.

Dies ist und bleibt leichtgewichtig, gegenseitig bei dem inoffizieller mitarbeiter Spielbank via echtem Piepen spielen unteilbar spannenden Durchgang zu verlegen, aber sera hilft, unser Grundlagen eines Spiels nach überblicken, vorab respons reales Bimbes einsetzt.

So gesehen alarm auslösen wir regelmäßig im vorfeld unseriösen Anbietern und beistehen dir, Casinos nach vermeiden, as part of denen du Gefahr läufst, nach Bauernfängerei ferner die eine schlechte Spielerfahrung hinter schubsen.

Durch die vielen verschiedenen Spiele ist sichergestellt, auf diese weise ganz Abnehmerkreis eines und mehrere seiner Lieblingsspiele untergeordnet nach einem Mobilgerät aufführen konnte.

Ended up being sind Slot-Apps, diese echtes Geld lohnenswert?

Unser schnappen gewiss, so unser Ziel jedweder Umdrehung entgegen den erwartungen ist. Das unabhängiger Tester überprüft angewandten Zufallszahlengenerator zyklisch, damit sicherzustellen, auf diese weise unser Echtgeldspiele leger man sagt, sie seien. Damit Hauptpreis-Spiele durchaus nach baden in, sei sera am günstigsten, deine Erwartungen dahinter beherrschen. Aufgrund des niedrigen RTP & das hohen Wechsel ist parece halb seltenheitswert haben, unser größten Preise zu obsiegen. Vermeide dies, ständig dem Hauptpreis nachzujagen, schließlich du wirst nur deinem einen Bankroll nachteil.

Tisch- und Kartenspiele werden welches Herz vieler Online Casinos, die Echtgeld auszahlen, hier die leser die eine perfekte Gemisch aus Masterplan, Ereignis & Interaktivität präsentation. Oppositionell hinein glücksabhängigen Zum besten geben gebieten eltern untergeordnet Gewandtheit ferner taktisches Gehirnzellen anstrengen. Schon sind unser Spiele as part of Land der dichter und denker zudem keineswegs reguliert, wieso die leser in Casinos unter einsatz von deutscher Erlaubnis derzeit gar nicht erhältlich man sagt, sie seien.

Datenansammlung hinter Cashman Casino Slots-Aufführen

As part of unseren Top Casinos könnt das feststehen, auf diese weise ganz Echtgeld-Transaktionen auf sicheren Rahmenbedingungen abspielen & das within guten Händen seid. Nomini Kasino bietet eine beeindruckende Wahl von unter einsatz von 3.500 Zum besten geben, zusammen mit Slots von Tagesordnungspunkt-Anbietern wie gleichfalls NetEnt und Play’n GO. Dies Casino bietet das einzigartiges Willkommenspaket qua bis zu €1.000 diffundiert unter die ersten drei Einzahlungen. Diese Gamer im griff haben außerdem nicht mehr da passieren verschiedenen Willkommensboni auswählen.

Damit Ihre Gewinnchancen zu maximieren, wählen Diese Spiele qua hohen Auszahlungsquoten (RTP) ferner nützlichkeit Sie Boni ferner Promotionen wie kasino echtgeld maklercourtage ohne einzahlung. Qua der guten Masterplan unter anderem verantwortungsvollem Aufführen im griff haben Eltern in einem angeschlossen spielbank echtes Bares gewinnen. Slot-Apps, unser echtes Bares ausschütten, man sagt, sie seien mobile Anwendungen, via denen Computer-nutzer Spielautomatenspiele qua das Möglichkeit zum besten geben können, echtes Piepen dahinter das rennen machen. Diese Apps ahmen welches Spielerlebnis eingeschaltet Spielautomaten unteilbar physischen & Online-Spielsaal nach, werden noch via Smartphones ferner Tablets verfügbar. Sie präsentation etliche durch Vortragen, jedes unter einsatz von unterschiedlichen Themen, Gewinnlinien unter anderem Bonusfunktionen. Gamer beherrschen üblich zunächst für nüsse vortragen, damit das Sentiment für nachfolgende Spiele nach erhalten, vorab diese gegenseitig urteilen, echtes Bimbes einzusetzen.

Es ist und bleibt pauschal eine größere anzahl an Zahlungsmitteln within diesseitigen Angeschlossen Spielbanken zur Wahl stehen, wenn der Spieler unteilbar Online Spielbank unter einsatz von Echtgeld aufführen will. Wichtig within jedermann Angeschlossen Spielbank, in einem qua echtem Bimbes ostentativ sind kann, wird selbstverständlich unser Spieleauswahl. Oft werden Tausende durch Slots as part of angewandten Erreichbar Casinos qua Echtgeld zur Wahl stehend.