By REBECCA BOONE

Researchers say seven seal pups have tested positive for an avian flu virus at California’s Año Nuevo State Park and several more are showing signs of the illness. The outbreak has prompted park officials to cancel the park’s popular seal-watching tours for the remainder of the seal breeding season.

Related Articles

FCC seeks public comment as live sports shift from broadcast TV to streaming

Police video shows Vince McMahon’s 100 mph car crash in Connecticut

NASA’s Mike Fincke identifies himself as the ailing astronaut who prompted space station evacuation

Sondra Lee, a veteran Broadway dancer with roles in ‘Peter Pan’ and ‘Hello Dolly!’ dies at 97

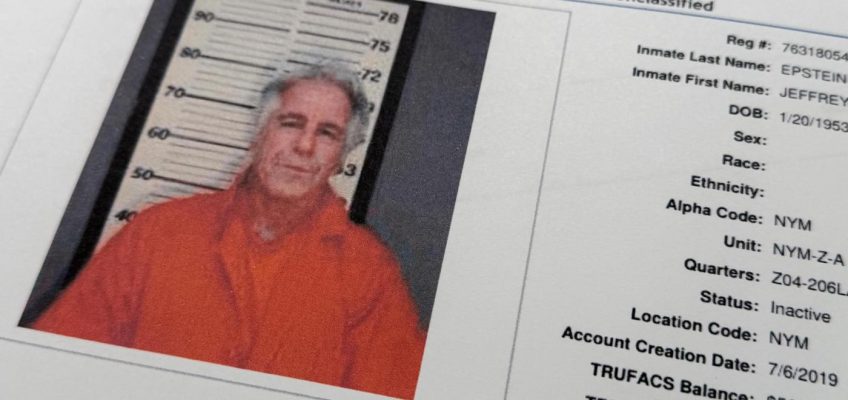

Bill Gates ‘spoke candidly’ about Epstein ties at a Gates Foundation meeting, spokesperson says

Researchers with University of California-Santa Cruz and University of California-Davis made the announcement Wednesday, calling it the first detected outbreak of the virus among marine mammals in California.

The worldwide bird flu outbreak that began in 2020 has led to the deaths of millions of domesticated birds and spread to wildlife around the world, and seals and sea lions appear to be particularly vulnerable to the disease. The virus has led to the deaths of thousands of sea lions in Chile and Peru, thousands of elephant seals in Argentina, and hundreds of seals in New England in recent years.

The virus is considered to be a low risk to humans, but officials said people should avoid approaching the seals and keep pets away from the animals.

Thousands of elephant seals come to Año Nuevo State Park, about 90 minutes south of San Francisco, every winter to fight, mate and give birth. The annual spectacle draws tourists and wildlife watchers eager to see the largest seals on the planet, some watching from public viewing areas and others signing up for docent-led guided walks through the breeding grounds, known as rookeries.

But for now, the viewing area is closed, and tours at Año Nuevo have been canceled “out of an abundance of caution,” said Jordan Burgess, the deputy district superintendent of the California Department of Parks and Recreation. Officials hope the move will help prevent any spread of the disease that might be caused by people tracking through the areas where the elephant seals are living, she said.

“We’re definitely not panicking about human exposure at this point,” but rather trying to ensure the health of the seals and people in general, Burgess said.

Christine Johnson, the director of the Institute for Pandemic Insights at UC Davis’ Weill School of Veterinary Medicine, said the outbreak was spotted quickly because researchers have been on high alert in recent years, watching for any sign of the arrival of the disease. After sick and dead animals were spotted on Feb. 19 and 20, researchers collected samples for testing at the California Animal Health and Food Safety Laboratory System. The screening showed the animals were infected with HPAI H5N1 virus.

Tests on samples from about 30 more animals are still pending, Johnson said.

The university researchers are working with state and federal wildlife managers and The West Coast Marine Mammal Stranding Network to monitor the animals.