By LINDSEY BAHR, Associated Press

On Nov. 8, 2018, the day one of the deadliest wildfires in U.S. history burned the town of Paradise, California, and killed 85 people, a school bus driver was sent to pick up 22 elementary school students to take them to safety. The Camp Fire was quickly spreading, communications were down and what was supposed to be a straightforward mission turned into a harrowing five-hour ordeal.

It’s these events that are dramatized in “The Lost Bus,” which opens in select theaters Friday before streaming on Apple TV+ on Oct. 3. Turning a recent, real-life tragedy (even the heartwarming stories that emerge from the ashes) into Hollywood entertainment requires a deft touch. Lean too far into the melodrama, and it risks resembling a made-for-TV movie. Keep it too clinical and it becomes a news segment.

But filmmaker Paul Greengrass, who has thrilled audiences with his Jason Bourne movies, taken them inside the Maersk Alabama hijacking and United flight 93, effectively toes that line. In “The Lost Bus,” he and co-screenwriter Brad Ingelsby have made an old-fashioned disaster movie that is captivating, frightening and startlingly moving.

Matthew McConaughey plays that bus driver, Kevin, who is having a very bad day already. His dog is terminal, he’s got bills he can’t pay, he’s taking care of his elderly mother in the months after his estranged father died and he’s just had an awful fight with his teenage son (a small, but effective performance from McConaughey’s actual son Levi).

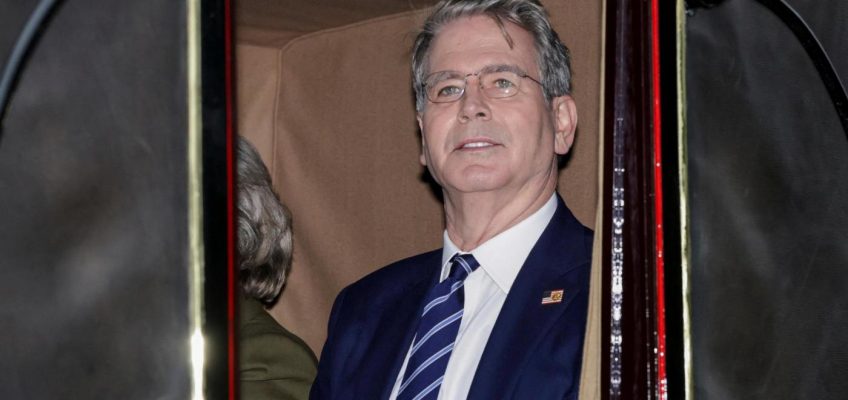

This image released by Apple TV+ shows filmmaker Paul Greengrass, center, during the filming of “The Lost Bus.” (Apple TV+ via AP)

Kevin just can’t seem to catch a break and is feeling sorry for himself, dealing with his boss, annoyed calls from his ex-wife and a teenager who woke up with a bad fever. Then he starts noticing the plumes of smoke in the distance. He’s on his way to deliver medicine to his son when the call comes in over the radio: Is any bus driver in the area available to deliver 22 children to a safe location? You can feel the agony, and slight annoyance, as Kevin waits for a beat hoping in vain that someone else is available.

Greengrass and Ingelsby smartly interweave Kevin’s lousy morning with the beginnings of the fire, showing the methodology of the competent first responders attempting to manage a situation that is quickly spiraling out of control. Greengrass sustains a feeling of dread for the duration of the film, a white-knuckle experience that only gets more stressful when the children are added to the equation.

When Kevin gets to the school, he’s not in any mood to gently walk the scared kids through this situation gently, insisting that a teacher, Mary ( America Ferrera ) come along for the ride to handle them. Kevin is not a likely hero. He’s barely even a reluctant one. He’s simply a down-on-his-luck guy who showed up and, ultimately, did something extraordinary.

This isn’t a superhero story, however he is treated with more empathy than, say, Tom Cruise’s bad dad in “War of the Worlds.” There is an interesting thread woven into the story about absentee dads and regret, that extends even beyond Kevin, his late father and his son.

Related Articles

Robert Redford’s neighbors reveal his quiet, ‘sad’ life in California

Movie Review: A suburban comedy of errors unspools in the darkly excellent ‘Adulthood’

Movie Review: ‘One Battle After Another’ is an American masterpiece

Movie review: ‘A Big Bold Beautiful Journey’ a big, bold swing, but a beautiful miss

Robert Redford, Oscar-winning director, actor and indie patriarch, dies at 89

Watching Ferrara and McConaughey drive this school bus through the flames and collapsing power cables sometimes brings “Speed” to mind. Occasionally, it veers a bit too far into spectacle and you start to question just how much the action has been upped for audience excitement. Perhaps these things really did unfold as they’re presented, but at times it feels like you’re suddenly on the Universal Studio Tour.

Still, it’s impossible to take your eyes off the screen, away from the inferno and the sense of our own smallness and helplessness to “battle it,” whatever that is supposed to mean. There is certainly a version of this story, adapted from Lizzie Johnson’s novel “Paradise: One Town’s Struggle to Survive an American Wildfire,” that could have focused on the firefighters. They do get a spotlight here, and the fire chief gets to say that these burns are only getting worse every year. But if you’re looking for that movie, perhaps you should turn to Joseph Kosinski’s “Only the Brave.”

“The Lost Bus” is about a few ordinary people in an impossible situation just trying to survive. While it’s not hard to wring emotion out of an audience watching kids in peril, it also, in some ways, gets right to the very heart of the matter.

“The Lost Bus,” an Apple Original Films release in select theaters Sept. 19 and streaming on Apple TV+ on Oct. 3, is rated R by the Motion Picture Association of America for “language.” Running time: 129 minutes. Three stars out of four.