By WYATTE GRANTHAM-PHILIPS

NEW YORK (AP) — As uncertainty deepens amid the U.S. government’s first shutdown in almost seven years, the gold frenzy continues to climb to new heights.

Related Articles

FACT FOCUS: Democrats did not shut down the government to give health care to ‘illegal immigrants’

Maine clinics also hit by cuts that targeted Planned Parenthood plan to halt primary care

Federal shutdown cuts off economic data vital to policymakers and investors

What polling shows about the politics of government shutdowns

FIFA VP pushes back on Trump comments about moving World Cup games from ‘dangerous’ cities

The going price for New York spot gold hit a record $3,858.45 per troy ounce — the standard for measuring precious metals — as of market close Tuesday, ahead of the shutdown beginning overnight. And futures continued to climb on Wednesday, dancing with the $3,900 mark throughout the day.

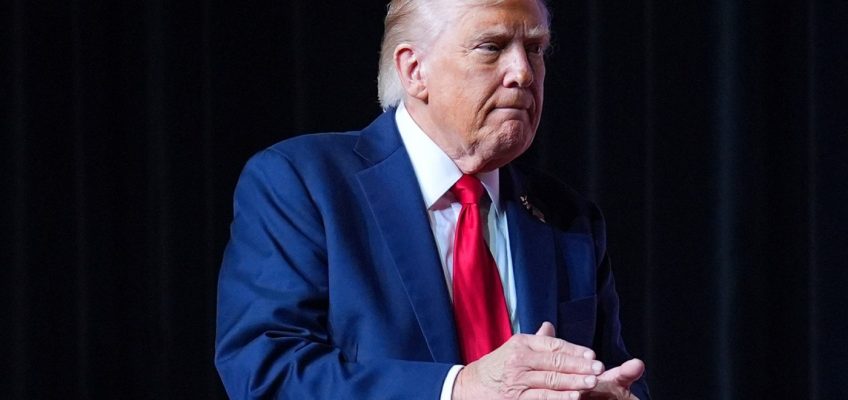

Gold sales can rise sharply when anxious investors seek “safe havens” for parking their money. Before Wednesday, the asset — and other metals, like silver — have seen wider gains over the last year, particularly with President Donald Trump ‘s barrage of tariffs plunging much of the world into economic uncertainty.

If trends persist, analysts have predicted that prices could continue to soar. Still, gold can be volatile and the future is never promised. Here’s what we know.

How much have gold prices climbed this year? What about silver?

Gold futures are up more than 45% since the start of 2025, trading at just under $3,895 by around 4 p.m. ET Wednesday.

Other precious metals have also raked in gains — with silver seeing an even bigger percentage jump year to date. Silver futures are up nearly 59%, trading at over $47 per troy ounce as of Wednesday afternoon.

Why are prices going up?

A lot of it boils down to uncertainty. Interest in buying metals like gold typically spikes when investors become anxious.

Much of the recent economic turmoil has spanned from Trump’s trade wars. Since the start of 2025, steep new tariffs the president has imposed on goods coming into the U.S. from around the world have strained businesses and consumers alike — pushing costs higher and weakening the job market. As a result, hiring has plunged while inflation continues to inch back up. And more and more consumers are expressing pessimism about the road ahead.

The current U.S. government shutdown could add to those anxieties. A key jobs report from the Labor Department, scheduled for Friday, is likely to be delayed, for example. And the shutdown itself threatens to bring its own economic fallout nationwide. Roughly 750,000 federal workers were expected to be furloughed, with some potentially fired by Trump’s Republican administration. Many offices will also be shuttered, perhaps permanently, as Trump vows to “do things that are irreversible” to punish Democrats for voting down GOP legislation.

The scope of impact could come down to how long the impasse lasts. Wall Street, meanwhile, has largely been unmoved by the shutdown so far — but Treasury yields dropped after discouraging hiring data from ADP Research Wednesday.

Investments in gold have also been driven by other factors over time. Analysts have previously pointed to strong gold demand from central banks around the world — including amid rising geopolitical tensions, such as the ongoing wars in Gaza and Ukraine.

Is gold worth the investment?

Advocates of investing in gold call it a “safe haven” — arguing the commodity can serve to diversify and balance your investment portfolio, as well as mitigate possible risks down the road. Some also take comfort in buying something tangible that has the potential to increase in value over time.

Still, experts caution against putting all your eggs in one basket. And not everyone agrees gold is a good investment. Critics say gold isn’t always the inflation hedge many say it is — and that there are more efficient ways to protect against potential loss of capital, such as derivative-based investments.

The Commodity Futures Trade Commission has also previously warned people to be wary of investing in gold. Precious metals can be highly volatile, the commission said, and prices rise as demand goes up — meaning “when economic anxiety or instability is high, the people who typically profit from precious metals are the sellers.”

And even gold’s current rally has seen some volatility. While still up significantly overall since the start of the year, there’s been a handful of short stretches with losses. Gold prices fell for several days following Trump’s sweeping “Liberation Day” announcement on April 2, for example.

If you do choose to invest in gold, the commission adds, it’s important to educate yourself on safe trading practices and be cautious of potential scams and counterfeits on the market.