Today is Friday, Oct. 24, the 297th day of 2025. There are 68 days left in the year.

Today in history:

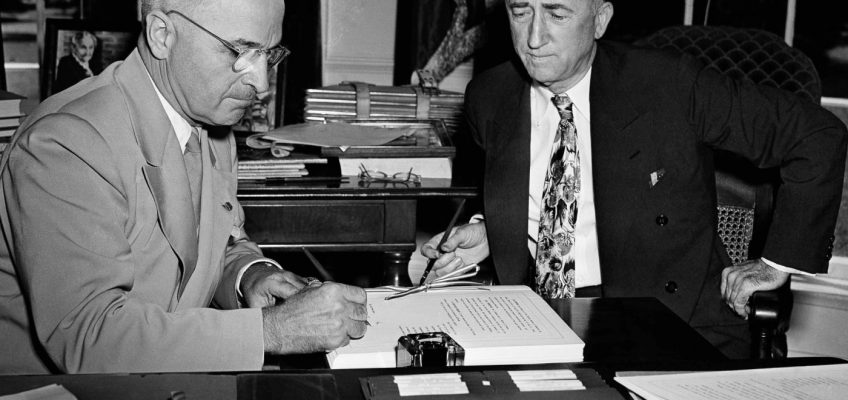

On Oct. 24, 1945, the United Nations formally came into existence as the Charter of the United Nations, ratified by 51 nations, took effect. The date is now observed as United Nations Day.

Also on this date:

In 1537, Jane Seymour, the third wife of England’s King Henry VIII, died 12 days after giving birth to Prince Edward, later King Edward VI.

Related Articles

California union proposes one-time tax on billionaires to offset Medicaid cuts

Columbus Zoo welcomes second Asian elephant calf this year

How cheaters rigged high-stakes poker games with the mob and sports pros, according to authorities

Contaminated meat was linked to 1 in 5 UTIs, according to a study

Trump issues disaster declarations for Alaska and other states but denies Illinois and Maryland

In 1861, the first transcontinental telegraph message was sent by Chief Justice Stephen J. Field of California from San Francisco to President Abraham Lincoln in Washington, D.C.

In 1929, a massive sell-off at the opening bell of the New York Stock Exchange led to chaos as stockbrokers couldn’t keep up with trade requests. Though the market recovered some losses by the end of the day, “Black Thursday” marked the beginning of the Wall Street Crash of 1929.

In 1931, the George Washington Bridge, connecting New York City with New Jersey, was dedicated. It was the world’s longest suspension bridge at the time.

In 1952, Republican presidential candidate Dwight D. Eisenhower vowed to go to Korea as he promised to end the ongoing conflict there. (Eisenhower would indeed visit Korea in December, after winning the election but before his inauguration.)

In 2002, authorities arrested John Allen Muhammad and teenager Lee Boyd Malvo near Myersville, Maryland, in the Washington-area sniper attacks that killed 10 people and wounded three that month. (Malvo was later sentenced to life in prison. Muhammad was sentenced to death and executed in 2009.)

In 2003, a British Airways flight from New York to London marked the final commercial flight of the supersonic Concorde jet.

In 2012, Hurricane Sandy roared across Jamaica and headed toward Cuba on its way to the eastern United States; what became known as Superstorm Sandy was a combination of the hurricane and other storms that struck New York and surrounding areas, killing 147 people, 72 in the eastern U.S.

In 2024, the owner and manager of the cargo ship Dali agreed to pay more than $102 million in cleanup costs to settle a federal government lawsuit stemming from the 2023 collapse of the Francis Scott Key Bridge. The Dali had crashed into a supporting column, destroying the 1.6-mile span and killing six members of a roadwork crew.

Today’s Birthdays:

Rock musician Bill Wyman is 89.

Actor F. Murray Abraham is 86.

Actor Kevin Kline is 78.

Sen. Mike Rounds, R-S.D., is 71.

Sen. Jeff Merkley, D-Ore., is 69.

Actor B.D. Wong is 65.

English soccer manager and former star midfielder Wayne Rooney is 40.

Singer Monica Arnold is 45.

Fashion designer Zac Posen is 45.

Singer-rapper Drake is 39.

Actor Ashton Sanders is 30.

NBA All-Star Jaylen Brown is 29.

Actor Hudson Yang is 22.