Tim Kersey doesn’t carry his phone with him at cross country meets. But Como Park’s coach had a deal in place with Cougars star alum and current assistant coach Innocent Murwanashyaka for the state meet on Nov. 1.

Murwanashyaka would pull up the results at meet’s end, find Kersey and hand him his phone without saying a word.

So, that’s what he did.

When the time came, Kersey grabbed the phone, took one brief glance, and threw Murwanashyaka’s phone to the ground. The Cougars had turned in a dream performance, with everyone in the lineup producing career- or season-best times. Charlie Loth won the individual title. Ben Clark placed ninth, Arthur Anderson was 11th.

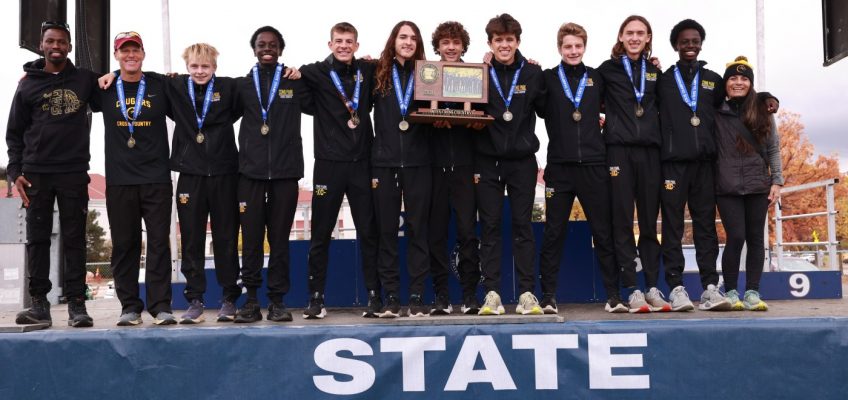

Most important, Como Park’s boys were the Class 2A team state champions.

The Cougars owned the day. The titles — both Loth’s individual and the Cougars’ team crown — were program firsts. Como Park’s boys team cross country championship was a St. Paul public school first.

Como Park junior Charlie Loth races to a Class 2A boys individual state title at Les Bolstad Golf Course on Saturday, Nov. 1, 2025. (Cheryl A. Myers / MSHSL)

It was all a long time coming, the culmination of a decade-plus build not just of a program, but a community.

The work

Como Park has produced many individual standouts during Kersey’s decade coaching the Cougars. Murwanashyaka, Florence Uwajeneza and Charlie Power-Theisen all won individual titles in the Roy Griak Invitational.

Power-Theisen now runs at St. Thomas. Murwanashyaka went on to become a Division-II All-American, while Uwajeneza won an individual national championship at the Division-II NCAA track and field meet in the 5,000 meter run.

Loth joined the Como Park individual Mt. Rushmore when he became the program’s first individual cross country state champion last week.

But it wasn’t until a Saturday morning in 2021 when Kersey knew the Cougars could reach the top of the team sport.

Voluntary workouts had been attended by the team’s elite runners early in Kersey’s tenure, but on this specific day at Afton state park, a team full of athletes was waiting for the coach at the gates.

“I just thought, ‘We’re going to make it to state, and this is going to be a tradition,’ ” Kersey said. “That’s the process.”

Clark lauded Kersey’s “precision workouts.” There’s a clear plan in place that’s thoroughly thought-out and explained. Kersey noted he wants to be ready for his runners each day, “So they’re ready for us.” It’s easy for kids to buy into the work when they know the “why.”

For instance, Como Park’s state championship performance last Saturday was filled with runners delivering their personal-best times on the biggest stage. That’s the goal every season.

It’s why the Cougars push heavy mileage training — up to 60 miles a week — that can produce non-elite meet times in regular-season meets. The objective is ultimately to, as Kersey put it, “land the plane on the aircraft carrier” at state.

“Hey, if we really want to peak at the right time, we’re going to have to put on some mileage here, and maybe not worry about race performances tomorrow or next week,” Kersey said. “Just have that first week in November always circled and emphasizing the more that they can work hard together and train together, the better off they’ll be at the end of the season.

“The kids have just been able to really embrace training and working hard together and being able to see those rewards from their hard work, and I think that’s really built on itself.”

School house

Clark said he was personally motivated to attend workouts by Power-Theisen, and that senior class of Como Park runners at large.

“Him and the seniors that year just had such a good group, and I just loved hanging out with those guys,” Clark said. “It was fun to be with a group of older guys just having a good time, going on long runs on Saturday. It just brought out a culture of wanting to be at practice, because sometimes being at practice was the best part of my day. I could just hang out with my friends and go run, which is what I love.”

Kersey describes the program as a “one-room schoolhouse” featuring kids from Murray Middle School and Como Park Senior High.

“You have the older kids who really help out the younger kids, but the younger kids really bring a lot to practice with the older kids,” Kersey said. “So it’s a great, symbiotic relationship there.”

Loth called the community created within the program “amazing.” Everyone gets along well and connects, from the seniors down.

“You can get a lot done when everyone is getting along with each other and motivating each other and working their hardest,” Loth said. “I think over time, when people join, they buy into that community and it keeps making it stronger and stronger, and I think that’s one of the reasons we did so well.”

Kersey noted the volume of runners in the program, and parents attending events, grows each year. People want to be a part of it and contribute to the cause. He built that community by emphasizing more than the times on a stopwatch.

“(He) focuses on all the athletes,” Loth said. “He makes sure that the younger athletes really feel welcome, feel comfortable.”

Kersey cited the program’s geographical advantages with the various fields and parks the Cougars can run at to keep things fresh.

Those voluntary Saturday morning runs are followed by a team breakfast at someone’s home. They also hold pre-meet pasta dinners. This year, the runners played a version of “fantasy cross country” — a play on fantasy football. The team attended a running camp at Big Horn last offseason, at which the athletes spent every moment of every day with one another.

The Cougars run well as a pack at least in part because they are one at their core. There’s a reason Murwanashyaka came back to help coach the program, and Power-Theisen and other alums still attend so many meets.

Believe

The 2021 state meet marked Como Park’s first since 1981. The Cougars finished 14th that year, cause for celebration.

“The kids were just super excited,” Kersey said. “After state, we talked about, ‘Hey, you guys did great, but Como can always be that team.’ ”

As in, the one on top of the podium. That’s not the place where St. Paul public school programs usually stand. But the Cougars believed more and more in themselves as the seasons passed and the results stacked up. The 2024 state meet was an eye-opener. The Cougars finished fourth, and had a lot of talent returning the next fall.

Clark recalled friends from other teams telling him, “You guys are going to win next year.”

“It was kind of an ego boost,” Clark said. “I think we just needed to know that we could win it, because we’ve just never really done that sort of thing before, ever.”

He added he also drew confidence and inspiration from the Highland Park girls team winning the team title in 2024.

“Which shows what a St. Paul team can do,” Clark said.

The Cougars are now another example as the first St. Paul boys public school team to ever win a state cross country team title. Loth noted that honor “means a lot to us.”

“St. Paul schools don’t win these state titles very often at all,” he said. “It’s always these big suburb schools that have a lot more financial backing. And I think it means a lot that we came together as a school and as a team. We just put our all into it, and just with an amazing team and an amazing effort we were able to do it.”

State volleyball: Lakeville South sweeps Class 4A state title match

Football: Mistakes doom Cretin-Derham Hall in state quarterfinal loss to Chanhassen

State volleyball roundup: Hawley, Mayer Lutheran repeat as champs

Football: St. Thomas Academy defense makes late stand to win Class 5A quarterfinal

State football: Dean runs for 6 TDs as Lakeville South dethrones Maple Grove