By Erik Wasson, Bloomberg News

President Donald Trump and top congressional leaders have strong political incentives to stoke the ongoing stalemate during a White House meeting Monday even as they drive the U.S. to its first government shutdown in nearly seven years.

Related Articles

Trump administration opens more land for coal mining, offers $625M to boost coal-fired power plants

Trump takes his tariff war to the movies announcing 100% levies on foreign-made films

Dar Global to launch a $1 billion project in Saudi Arabia in a deal with Trump Organization

What we know about Trump’s peace proposal for Gaza

Trump’s big bill is prompting urgent action in some Democratic states, but not in Republican ones

Democrats are keen to use the shutdown battle to frame the next election around rising costs, particularly for health care. Republicans are equally eager to blame the Democrats and show them to be poor stewards of the government and the U.S. economy ahead of the 2026 midterms.

Progressive Democrats are putting party leaders under enormous pressure to show they are willing to fight the Trump administration. Those leaders are confident they can unite their caucus behind the health care issue and prevent a defection by the eight Democrats needed to pass the Republican bill, which would keep the government funded until Nov. 21.

GOP leaders say they can negotiate after the short-term bill is passed, but Democrats have said they don’t trust Trump or the Republican leaders to keep that promise. White House Press Secretary Karoline Leavitt told Fox News Monday that Trump has leverage in the fight because the public dislikes government shutdowns.

“There is zero good reason for Democrats to vote against this clean continuing resolution,” Leavitt said. “The president is giving Democrats one last chance to be reasonable today. Look, there is nothing to negotiate when you have a clean CR look.”

Democrats want to spend $350 billion to permanently extend Obamacare tax credits to middle-class families, to avoid a premium spike on Jan. 1. They also want the bill to repeal Medicaid cuts in the giant Trump tax bill, including new work requirements and a crackdown on an accounting gimmick that has allowed states to increase their Medicaid reimbursement rates. They also want to reverse cuts to medical research and block the White House from rescinding previously enacted appropriations.

“Our position has been very clear: cancel the cuts, lower the cost, save health care so we can address the issues that really matter to the American people in an environment where the cost of living is too high,” House Minority Leader Hakeem Jeffries said Sunday on ABC’s This Week.

Trump has tied Democrats’ demands to the hot-button issue of migration, accusing them of seeking to funnel $1 trillion in taxpayer funds for undocumented immigrants.

That claim is wildly exaggerated, but based lon an aspect of the Democratic proposal, which would effectively increase federal Medicaid reimbursements to states that pay for emergency care for undocumented migrants.

The non-partisan Congressional Budget Office estimates the current restriction saves $28 billion over 10 years. They also want to repeal a separate provision that clarifies parolees and asylum seekers with temporary permission to remain the U.S. can’t receive Obamacare subsidies would save $119 billion over 10 years.

Trump gave no indication Sunday that the meeting would offer an easy resolution.

“I just don’t know how we are going to solve this issue,” Trump said in a phone interview with CBS News. He continued his criticism of Democrats’ negotiation posture, saying “they’re not interested in fraud, waste and abuse,” which is the only thing Republicans claim they are cutting from the budget.

The Trump administration has also threatened Democrats with mass firings of federal workers in the wake of any shutdown, supercharging a downsizing overseen by White House budget Director Russ Vought.

Instead of merely furloughing non-essential workers, as is usual during a shutdown, the administration is preparing to permanently end a number of jobs likely in the areas of the environment, agriculture and labor regulation.

Senate Minority Leader Chuck Schumer on Sunday dismissed the threat as something Trump was going to do anyway. October layoffs were already in the works and the shutdown could allow the White House to blame Democrats for any economic fallout from the layoffs, while satisfying small-government conservatives in the party base.

Leavitt on Monday said that there won’t be any layoffs if the government remains open.

Democrats such as Senator Amy Klobuchar told reporters last week that the party is not demanding its entire proposal in exchange for voting for a GOP bill to keep the lights on through Nov. 21. The talks Monday signal the pressure on the White House to at least meet with Democrats worked.

“We never said that we need to have every single thing and that every single thing’s a red line. We want to negotiate with them to make this health care crisis less bad,” Klobuchar, the No. 3 Senate Democrat, said Friday.

She and other senators said this weekend that a mere promise from the GOP to talk later won’t suffice.

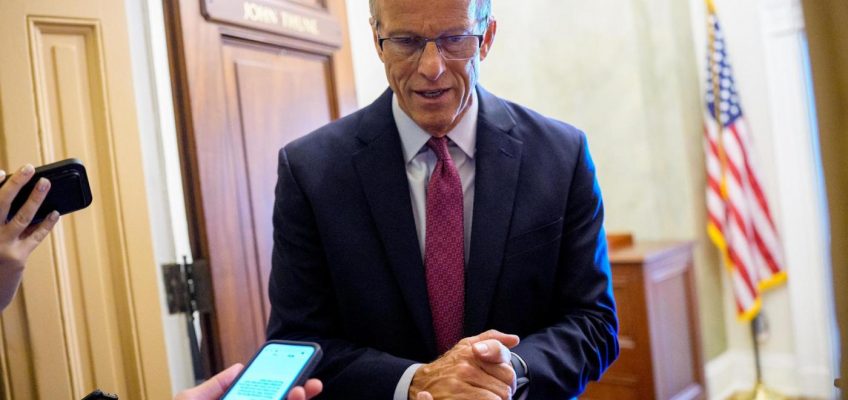

But that is precisely what Senate Majority Leader John Thune is suggesting.

“We can have that conversation. But before we do, release the hostage. Set the American people free. Keep the government open, and then let’s have a conversation about those premium tax credits,” Thune said on NBC’s Meet the Press. He said any possible deal on Obamacare subsidies isn’t ready.

Republicans are divided on the Obamacare issue. Twelve swing-district House Republicans have signed onto a bill to extend them by a year, while Alaska Senator Lisa Murkowski is spearheading an effort to extend them by two years. Other moderates say they want to phase in an income limit to prevent high earners from claiming the benefit and introduce greater fraud controls.

Conservatives are standing firm, arguing that the COVID pandemic-era subsidies were meant to be temporary. Some argue that any deal on the premiums would have to include new restrictions preventing Obamacare plans from covering abortion and transgender-related procedures.

House Speaker Mike Johnson said Sunday on CNN’s State of the Union that the meeting on Monday will be an opportunity for Trump to tell Democrats to drop their demands.

“Think of it, troops won’t be paid because Chuck Schumer needs political cover. I mean, it’s really that simple and I think everybody is going to see that clearly,” Johnson said. “The president wants to talk with him about that and say, ‘Don’t do that.’”

Schumer said he expects a substantive meeting.

“We’ll see on Monday — are they serious about negotiating with us,” he said.

With assistance from Lauren Dezenski and Josh Wingrove.

©2025 Bloomberg L.P. Visit bloomberg.com. Distributed by Tribune Content Agency, LLC.