Motley Crue joins the growing lineup at the new Mystic Lake Amphitheater in Shakopee with an Aug. 21 show booked with fellow ’80s rockers Tesla and Extreme.

Tickets go on sale at 9 a.m. Friday through Ticketmaster.

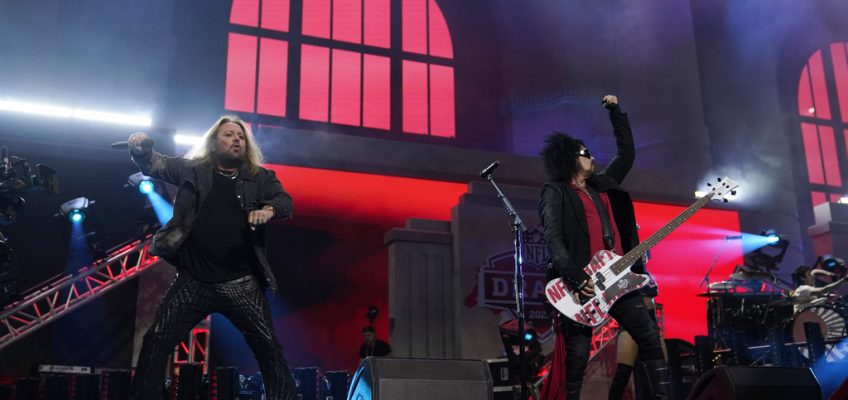

Known for such hits as “Home Sweet Home,” “Kickstart My Heart,” “Shout at the Devil” and “Smokin’ in the Boys’ Room,” Motley Crue splintered in 1992 when lead singer Vince Neil left the group (or was fired, depending on who you believe). Neil returned five years later, but soon after, drummer Tommy Lee retired from the group. The full lineup reunited in 2004.

Motley Crue unveiled plans for their farewell tour in January 2014 and went on to play 158 concerts around the world, including two at the former Xcel Energy Center in St. Paul and another at Minneapolis’ Target Center.

In 2019, Motley Crue announced they were reuniting, citing renewed interest in the band following the release of “The Dirt,” a Netflix biopic based on Motley Crue’s best-selling 2001 autobiography. Their massive comeback tour, which included Def Leppard and Poison, hit U.S. Bank Stadium in 2022 after several pandemic-related delays. The show confirmed that Neil’s voice remains a weak point in the group.

Related Articles

Buzzy newcomers Alex Warren and Olivia Dean book local arena shows

‘Weird Al’ Yankovic to play MN State Fair Grandstand for the seventh time

Despite no original members, Lynyrd Skynyrd and Foreigner will tour in 2026

An ageless Stevie Nicks charms Grand Casino Arena crowd

Pop star Meghan Trainor to play Grand Casino Arena in July

Founding guitarist Mick Mars, who has long struggled with the chronic form of arthritis ankylosing spondylitis, departed the group in October 2022 under mysterious circumstances. The rest of the band immediately announced former Marilyn Manson guitarist John 5 was taking his place. The new lineup drew 8,769 fans to the Minnesota State Fair Grandstand last year.

Not to be confused with Mystic Lake Casino’s own amphitheater, the 19,000 capacity Mystic Lake Amphitheater will open next year. Live Nation will operate the venue, which is expected to host more than 30 concerts each summer. The lineup so far includes Jack Johnson (July 12), 5 Seconds of Summer (July 22), Train (Aug. 9), Lynyrd Skynyrd and Foreigner (Aug. 16) and Iron Maiden (Sept. 19).