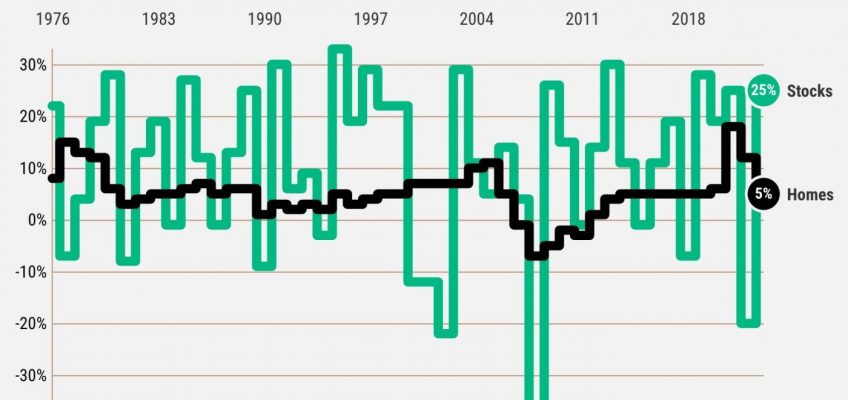

Stock performance clobbered home prices in 2023, the year after the reverse was true.

My trusty spreadsheet looked at a half-century of stock-trading patterns (the Wilshire 5000-stock index) and home-price swings (the Federal Housing Finance Agency US index) to determine how these two assets vary in price fluctuations.

Consider that the Wilshire was up 25% in 2023. Only 12 years have fared better since 1974.

Why the pop? Stock investors spent much of 2023 worried about a recession. It was only late in the year that trader sentiment turned toward an economic “soft landing” – motivation to bid up share prices anticipating a less-than-horrific 2024.

By the way, a similar “no deep recession” mentality helped US home prices a bit in 2023, too.

REAL ESTATE NEWSLETTER: Get our free ‘Home Stretch’ by email. SUBSCRIBE HERE!

The FHFA home index was rising at a 5% annual rate as of September, the latest reading available. That would rank as the 29th-best year.

Yet that seemingly substantial 2023 performance spread between stocks and homes – 20 percentage points of performance – was only the 14th widest on record.

Last year was quite a switch from 2022.

That year, the Wilshire tumbled 20% when recession fears were high – the stock market’s fourth-worst performance in 50 years. Yet the FHFA home index was up 12% in 2022, its fifth-best year, as house hunters ignored Wall Street worries and rushed to buy at the end of a cheap money era.

And please note that 2022’s performance chasm – 32 percentage points – was the largest on record.

Details

The spreadsheet shows wide differences between stock and housing prices to be the norm. A typical year has a 14-percentage-point gap between annual performances.

Basically, stocks and housing dance to different drums. Look what history tells us …

ECONOMIC NEWS: What’s the big trend? Should I be worried? CLICK HERE!

Average year: 10% gain for stocks vs. housing’s 5% appreciation.

Down years: There’s a 29% chance stock prices will decline over 12 months vs. 10% for homes.

Best year: Up 33% in 1995 for stocks vs. housing’s 18% in 2021.

Worst year: Both took historic spills in 2008 amid a global financial crisis. Stocks lost 39%, US homes were down 7%.

Those extremes reveal the volatility of the stock market’s rollercoaster ride – 72 percentage points between Wilshire’s best and worst years while housing’s spread was just 25 points.

Bottom line

What does it take to narrow this performance gap?

When you rank the past half-century from thinnest to widest gaps, and then ponder key economic stats, you see it takes near-perfect business conditions to have stocks and homes with relatively equal outcomes.

Small-gap years see average US job creation at 2.1% vs. 1.1% when gaps are largest. Meanwhile, inflation was milder, with an average 3.3% increase in the Consumer Price Index vs. 3.8%.

Curiously, when price swings for stocks and homes are close, stocks are gaining at a below-average rate of 7% vs. an above-par 6% for homes.

HOW NIMBY ARE YOU? Ponder common objections to new housing. TAKE OUR QUIZ!

Yet when gaps are the widest, in dicier economic times, stocks seem to thrive. The Wilshire averaged 11% yearly gains when stock-housing spreads were at their peaks, compared with a 5% appreciation rate for homes.

Why? My guess is that stock traders often bet ahead of the curve, hoping for better times ahead. Homebuyers prefer calmer times.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com

2024 economic forecasts

Chapman: ‘Very slow growth. No recession’

CS Fullerton: ‘Cracks’ will widen to a mild recession in late 2024

US Realtors: Housing rebound from 2023’s dismal sales

California Realtors: Rising prices, sales in 2024

USC: SoCal rents to rise 2-4% a year through 2025

Related Articles

Is 2024 a good time to buy a vehicle? Here’s the projection

Mortgage questions to ask and expect from your lender

4 things that could impact your credit in 2024

12 things that you can buy on sale in January

10 best money-making apps in 2024

Leave a Reply