Why save snorkeling for a cruise ship excursion or a resort stay when we have world-renowned snorkeling destinations right here in our own backyard?

Reefs and trails await underwater explorers just beneath the surface of the ocean’s warm, blue waters off the shoreline in Broward and Palm Beach counties.

Need an escape from the daily stresses of life? Grab a snorkel and mask, wade into the surf and submerge yourself in a world in which the only traffic you’ll encounter is a vibrant school of fish swimming by, or a graceful sea turtle crossing your path.

Of course, before you dive in, there are several things to figure out: the right location for your skill level, the necessary equipment, access points, cost, safety factors, and parking and other amenities.

We’ve taken all of this into account when compiling our list of must-snorkel spots that are easily accessible right from the beach — no boat required — and are either free or, in some cases, involve only parking or park fees.

SAFETY FIRST

Before anything else, let’s talk safety. Here are some important tips for snorkelers, courtesy of the Palm Beach County Parks & Recreation department’s website:

Know your personal swimming limitations and snorkeling abilities.

Always snorkel with a buddy so you can share your experiences and have somebody to help if needed.

Check the ocean conditions, including waves, currents, wind, water visibility and weather.

Decide on entry and exit points.

Keep in mind that the best time to snorkel is within two hours before or after high tide.

“If unsure of skills, stay within lifeguarded areas,” Fine said. “Look but don’t touch is the slogan to follow with snorkeling, and keep feet and hands off coral and marine life.”

EQUIPMENT CHECKLIST

Next, we asked marine biologist and Master Scuba Instructor John Christopher Fine — who calls Boynton Beach home when he’s not traveling around the world exploring shipwrecks and studying ocean pollution — about the equipment first-time snorkelers need before heading out into the water.

He said to start with the basics: a mask, snorkel and pair of fins (or swim shoes). Also, “wear a dive skin or nylon tights and top to protect from sun as well as stings,” he added. “Skins are inexpensive online, last a long time and are far less expensive than coral-killing sunscreens.”

A dive flag and float are required for safety and to comply with Florida law, he said.

“For beginners, I suggest a car inner tube on a yellow (polypropylene) line with a weight at the end, so the line can be dropped and the tube not float away,” he said, adding that a dive flag can be tied to it or secured with a special device.

“A tube is great to rest, holding on to it,” but it should be made of strong materials, not a typical pool float.

PLACES TO SNORKEL

Ready to jump in? We’ve gathered six snorkeling spots where you can meet marine life and experience the serenity of the sea.

And if you want a snorkeling sneak peek beforehand, just search YouTube.com for underwater videos by divers and snorkelers featuring the locations on our list below.

A guarded swimming area under the Blue Heron Bridge leads to the snorkel trail at Phil Foster Park in Riviera Beach. (Carline Jean/South Florida Sun Sentinel)

PALM BEACH COUNTY

Phil Foster Memorial Park Snorkel Trail 900 E. Blue Heron Blvd., Riviera Beach

HOURS: Sunrise to sunset

PARKING: Free

INFORMATION: discover.pbcgov.org/parks

An underwater paradise awaits snorkelers of all levels on the south side of the Blue Heron Bridge, just beyond a guarded swimming area. Venture out about 200 feet to explore submerged structures and shark sculptures while keeping an eye out for some of the trail’s residents, including squid, octopuses, spotted rays and starfish. Six hundred tons of rock were used to build the artificial reef, made of limestone boulders and prefabricated reef modules that span 2 acres in 6 to 10 feet of water, according to the county. Need to take a break? Cool off in the shade on the beach under the bridge. To the south, you’ll see Peanut Island, another popular snorkeling location accessible by boat or ferry.

Ocean Inlet Park/Lofthus shipwreck6990 N. Ocean Blvd., Boynton Beach

HOURS: Sunrise to sunset

PARKING: Free

INFORMATION: discover.pbcgov.org

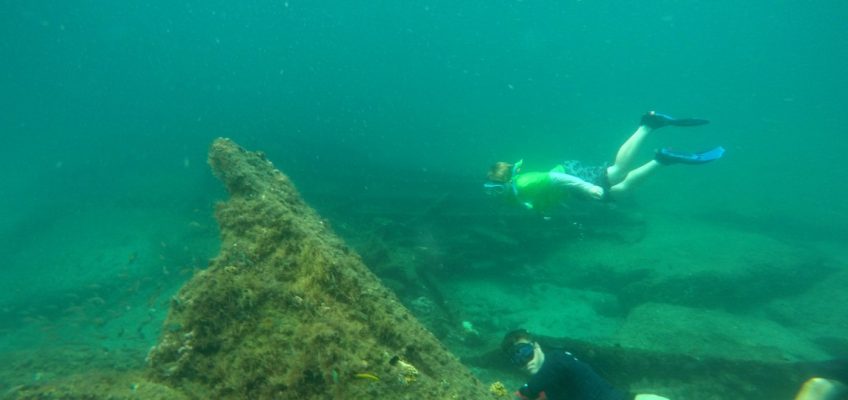

Whether you park and walk across Ocean Boulevard or under the road by the jetty, when you see the shoreline rocks along the guarded beach on the south side of the inlet, you’ve found the entry point to another popular snorkeling spot. Suit up with your equipment and wade into the ocean. Sea turtles, nurse sharks, reef fish and corals have all been spotted in the waters. For intermediate to advanced snorkelers who swim beyond the guarded area, be aware of boat traffic.

For those looking for a challenge, the Lofthus shipwreck is 1.1 miles north of the inlet, about 150 yards offshore in about 10 to 18 feet of water, Fine said. Park at Ocean Inlet Park and make the trek along the beach before the high-tide mark. He has seen guitar fish, a nurse shark and spiny lobsters hanging around the wreckage.

“Watch the weather. When the ocean is rough, waves break in shore and the shipwreck remains are not safe to dive,” he said. “Calm ocean and little wind make it a fun place to explore.”

Red Reef Park Snorkel Trail 1400 N. Ocean Blvd., Boca Raton

HOURS: 8 a.m. to 10 p.m.

PARKING: $35 on weekdays and $50 on weekends/holidays (day pass); $3 per hour at metered lot across State Road A1A

INFORMATION: myboca.us

Twenty artificial reefs just offshore and a jetty that extends from the beach into the water make up the snorkel trail. Walk directly into the ocean from the guarded beach and be on the lookout for sergeant major, parrotfish, bar jack and spottail pinfish. Snorkelers also have reported seeing a small reef shark, eels, lobsters, crabs, stingrays, barracuda and a sea turtle on their adventures.

Fourteen of the reefs were installed in late 2021, which extended the snorkeling trail. They are constructed from native limestone boulders sourced from a quarry near Fort Pierce, according to the city.

“Creating an artificial-reef snorkel trail offers residents and visitors another unparalleled outdoor experience in the city,” said recreation services director Greg Stevens. “This unique attraction not only provides a stunning adventure for snorkelers but also fosters a thriving and sustainable habitat for local marine life.”

It’s the ideal location for children to learn to snorkel and get up close with ocean life as well.

“I was able to view beautiful sea life such as turtles, colorful and bigger fish,” said 12-year-old Boca Raton resident Shea Ferris, who snorkels there. “It’s a safe and peaceful place for them, and I was able to enjoy everything around me.”

BROWARD COUNTY

Shipwreck Snorkel TrailDatura Avenue and El Mar Drive, Lauderdale-by-the-Sea

HOURS: Sunrise to sunset

PARKING: Metered parking on side streets or at South Ocean Lot, 4324 State Road A1A

INFORMATION: discoverlbts.com/diving-snorkeling

Just south of Anglin’s Fishing Pier, one of Broward County’s most popular dive and snorkeling areas provides a trail in 10 feet of water and three coral reefs just off the beach.

“Recognized as ‘Florida’s Beach Diving Capital,’ Lauderdale-by-the-Sea’s quaint Florida town is teeming with beautiful marine life in the calm, clear waters less than 100 yards off the white sand beaches, making it one of the best beaches in Florida to go snorkeling or diving with the little ones,” said town spokeswoman Aimee Adler Cooke. “The whole family can enjoy snorkeling, diving, kayaking and paddleboarding right off the beach.”

She said the town is a designated Blue Wave beach, a distinction given by the Clean Beaches Coalition to clean and environmentally responsible beach communities.

The Shipwreck Snorkel Trail, which includes an anchor, five concrete cannons and a ballast pile, was dedicated in 2002 by explorer Jean-Michel Cousteau (Jacques Cousteau’s son), according to the town.

The waters also are home to the SS Copenhagen, a British shipwreck in a Florida Underwater Archaeological Preserve, that is reachable by boat.

Walk from the parking lot to the beach and straight into the ocean at Vista Park in Fort Lauderdale to begin snorkeling. (Carline Jean/South Florida Sun Sentinel)

Vista Park Reef2851 N. Atlantic Blvd., Fort Lauderdale

HOURS: 6 a.m. to 9 p.m.

PARKING: Metered parking lot open from 8 a.m. to 8 p.m.

INFORMATION: parks.fortlauderdale.gov

Just steps from the parking lot at Vista Park, a hidden gem among snorkeling enthusiasts is bustling beneath the blue ocean waters. The reef line starts about 300 feet out from shore and extends past the buoys. The area is the midway point of the reef that runs north and south. More advanced snorkelers can head out to the deeper depths of the reef. What will you see? Hard and soft corals, tropical fish and sea fans. Go early when water clarity is at its best.

Dr. Von D. Mizell-Eula Johnson State Park in Dania Beach offers more than 2 miles of beaches and snorkeling spots offshore. (Mike Stocker/South Florida Sun Sentinel)

Dr. Von D. Mizell-Eula Johnson State Park/Erojacks6503 N. Ocean Drive, Hollywood

HOURS: 8 a.m. to sunset

ADMISSION: $6 per vehicle (up to eight people); $4 for a single-occupant vehicle or motorcycle; $2 for pedestrians, bicyclists, extra passengers, passengers in vehicle with holder of Annual Individual Entrance Pass

INFORMATION: floridastateparks.org/mizell

There are various places to snorkel along the 2.5 miles of beach in the park, but one of the unique areas is the Dania Beach Erojacks, an artificial reef that runs east to west made up of concrete jacks structures. To find it, drive north to parking lot #1, walk across the bridge and to the right, follow the service trail signs in the sand heading south. You will enter the beach area at the spot where the reef is less than 600 feet offshore. The Dania Beach Pier is visible just to the south. Put your dive flag out and look for eels, fish, coral, slipper and spiny lobsters, stingrays, puffer fish and starfish. Keep in mind that the northern end of the state park, including the jetty parking lot, Jetty Pier and beach access, is closed to the public for construction.