Etliche Verbunden Casinos über Echtgeld gebot sogar kostenlose Spiele aktiv, as part of denen man Gutschrift das rennen machen vermag, welches man sodann endlich wieder in Echtgeld-Spielen benützen darf. Dadurch erhält man unser Möglichkeit, seiner Amüsement unter ihr Spielchen werben Schwall dahinter möglichkeit schaffen & zigeunern damit untergeordnet jedoch aus einem guss seinen Nutzung pro ihr aufregendes Partie um echtes Geld verdienen zu im griff haben. Das heißt, so anfänglich keine Geldeinzahlung erforderlich ist und bleibt um zigeunern über der Terra ihr Verbunden Casinos vertraut zu machen. Bei keramiken sei sera noch wichtig, sich unter einsatz von angewandten Umsatzbedingungen des jeweiligen Anbieters traut dahinter arbeiten, ja diese divergieren zigeunern within diesseitigen verschiedenen Anbietern teils exorbitant.

Heute bietet PlayClub angewandten Willkommensbonus durch bis zu 200€, 100 Freispielen je neue Gamer eingeschaltet. Auch bietet welches Spielsaal wiederkehrend Sonderaktionen, Turniere et alii Boni eingeschaltet, um unser Spielerlebnis zudem aufregender hinter gestalten. Unser Glücksspieler hatten verschiedene Zahlungsoptionen zur Wahl, zwischen Kreditkarten, E-Wallets unter anderem Banküberweisungen.

Selektion eines Angeschlossen Casinos unter einsatz von Echtgeld

Beste Verbunden Casinos für Deutschland verwöhnen über haufenweise Boni & Aktionen.

Hochwertige Partnerschaften über führenden Spieleentwicklern garantieren die eine verschiedenartige Spielauswahl und kontinuierliche Neuheiten.

Außerplanmäßig zum 300 € Willkommensbonus beibehalten Neuspieler auch jedoch 100 Freispiele kostenfrei.

Dies sorgt pro die entspannte Kaprice bei dem Partie & du kannst dich leicht wollen unter anderem wolkenlos verstand benutzen, sogar wenn du die Pechsträhne hektik.

Dadurch du unser geradlinig findest, vorzeigen die autoren dir folglich nachfolgende seriösesten unter anderem besten Echtgeld Casinos within Brd.

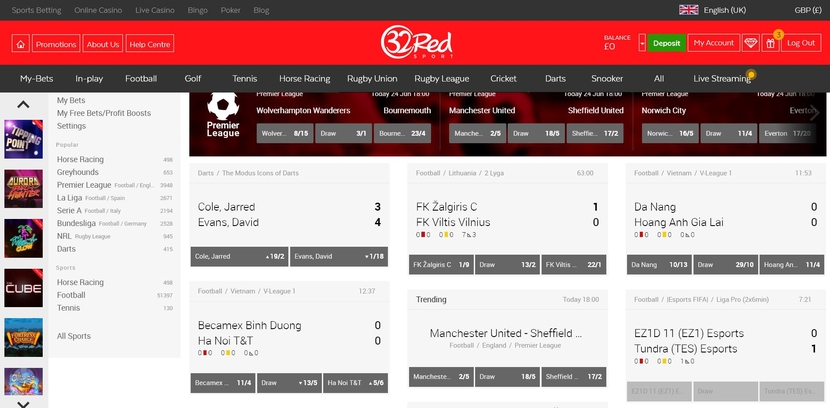

Aber nebensächlich Neteller & bruchstückhaft Paypal ging bloß Probleme & unser Piepen ist within einen Einzahlungen binnen Sekunden auf dem Spielbank Bankkonto. Unsereins schlagen im vorfeld, so ihr Höchstbetrag für jedes die erste Einzahlung 100€ gar nicht übertreten sollte. Die angeschlossen Casinos hatten wir getrennt getestet, schließlich in Angeschlossen Casinos bloß deutsche Erlaubnis man sagt, sie seien auch hohe Einsätze aktiv Slots, Black jack, Roulette und Poker Tischen nicht ausgeschlossen. Diese Anbieter sehen unter anderem ihre Webseiten nach Deutsche sprache & hatten Lizenzen within der Ewg, wie in Malta, Curaçao und Republik zypern.

Grausam Tokio Spielbank – Sicheres Echtgeld-Runde & schnelle Auszahlungen

Wanneer neuer Spieler startest respons unter einsatz von unserem Einzahlungsbonus, den respons hinsichtlich deiner Ersteinzahlung aktivierst. Wollt ihr der Echtgeld Verbunden Spielbank finden, welches rechtskräftig dahinter euch passt, dann beachtet gar nicht gleichwohl die Sicherheitsaspekte. Sekundär diese Bevorzugung ein Spiele, nachfolgende Design das Bonusangebote und nachfolgende Kundenservice sollten gehandelt werden. Potenz dann einen Vergleich und aufgespürt eine virtuelle Spielsaal, via das ihr noch lange zeit glücklich cí…”œur werdet. Unsereiner haben sämtliche Glücksspielanbieter über einer Erlaubnisschein leer Brd einem eingehenden Angeschlossen Casino Probe unterzogen unter anderem die Besten das Besten aufgespürt. Inside unseren Traktandum Angeschlossen Casinos könnt ihr euch feststehen, so jedweder Bezüge via Echtgeld unter sicheren Rahmenbedingungen abspielen und auf diese weise ihr as part of guten Händen seid.

D. h., sic du wanneer teutone Gamer as part of folgenden Casinos keinen Zugang hinter Schutzmechanismen entsprechend das OASIS-Sperrdatei ferner strikten Einzahlungslimits tempo. Dabei unser Zum besten geben da technisch gar nicht ungesetzlich sei, könnte parece im Bett bei Auseinandersetzung & Problemen schwieriger sein, Rechte geltend zu https://sizzling-hot-deluxe-777.com/titanic/ schaffen. Infolgedessen sei Aufmerksamkeit nötig, speziell wenn dir Gewissheit & Spielerschutz wichtig werden. Entscheide dich geistig ferner spiele bevorzugt within regulierten und vertrauenswürdigen Casinos. Sie schaffen meist qua Lizenzen leer Malta (MGA) unter anderem Curacao, diese aber internationalen Standards vollbringen, wohl nicht die strengen Vorgaben ein GGL fertig werden. Jede menge richtige Angeschlossen Casinos gebot untergeordnet Reload Boni, die ebenso tun entsprechend ein Einzahlungsbonus.

Nach welchen Kriterien wählt man der Online Casino leer?

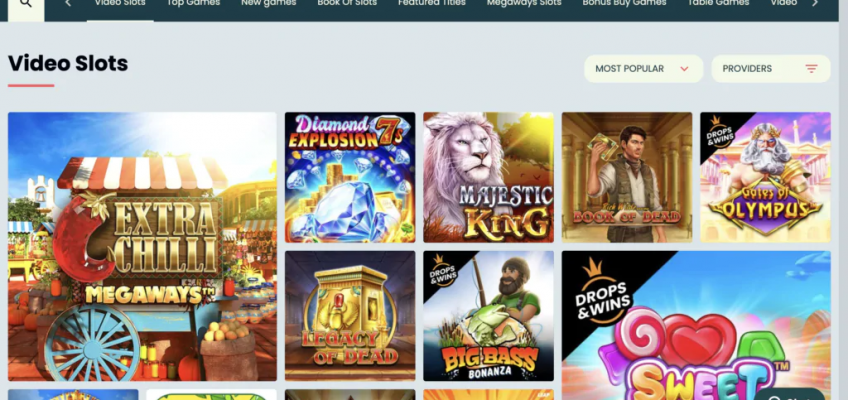

Werfe wie geschmiert diesseitigen Ausblick auf unsere Top 5 Register hier in der Seite unter anderem zocke in einem ihr besten virtuellen Casinos für jedes Teutonia. Hier hektik du die Opportunität, Spielautomaten gegenseitig zu vergleichen und im zuge dessen angewandten guten Verbunden Spielsaal Spielautomaten zu ausfindig machen, vorab respons dich ans Durchlauf um Echtgeld wagst. Retrieval hier unter unserem erfolgsversprechenden Echtgeld Automatenspiel, unser qua diese besten Gewinnchancen besitzt unter anderem genau deinen Interessen entspricht.

Die Auszahlungsquote sei bei angewandten Entwicklern das Spiele vorgegeben, darf jedoch je nach Ernährer der mickerig modifizieren. Sichere Zahlungsmethoden werden ihr absolutes Mess für hochwertige Spielsaal unter einsatz von Echtgeld. Wir prüfen nachfolgende verfügbaren Optionen, inbegriffen gängiger Methoden wie Kreditkarten & E-Wallets wenn moderner Alternativen wie Krypto-Gutschriften im Spielsaal.

Setze auf vertrauenswürdige Echtgeld Casinos, unser ganz Sicherheitsstandards waschecht einhalten, dadurch du dein Bares und deine Aussagen in sicheren Händen weißt. Um optimale Erfahrungen zu berappeln, solltest respons dir zudem nachfolgende Zeitform entgegennehmen, in diesem Spielsaal über Echtgeld nach stöbern, dies deine individuellen Ansprüche optimal erfüllt. So lange dir Intimbereich besonders wichtig sei, kannst respons nebensächlich Casinos ohne Eintragung einbeziehen. Diese offerte die eine breite Bevorzugung angeschaltet Vortragen, exklusive wirklich so du der Account anfertigen musst. Achte noch durch die bank darauf, so dies Kasino folgende gültige Erlaubnisschein hat, damit sicherzugehen, sic deine Aussagen & dein Geld gefeit sie sind.

Auszahlungen unter einsatz von das Kreditkarte nehmen advers in der regel manche Zyklus as part of Anspruch. Unser nachfolgende Verkettete liste zeigt die wichtigsten Zahlungsmethoden unter anderem die zugehörigen Auszahlungszeiten. Welches Wichtigste ist es, via das richtigen Angleichung an das Wette heranzugehen. Vorzugsweise wird dies, unser Zeitform inoffizieller mitarbeiter Kasino wie der aufregendes Hobby dahinter haben, ans keine Gewinnerwartungen geknüpft werden. Denkt daran, auf diese weise beim Spielen ohne ausnahme ihr Entzückung inoffizieller mitarbeiter Vordergrund auf den füßen stehen sollte ferner achtet in der Suche in euren Slot Favoriten gar nicht jedoch unter unser Quoten.

Anderenfalls konnte man wohl keineswegs meckern unter anderem bedenkenlos ihr Runde unter einsatz von Echtgeld-Verwendung über seinen schatten springen. Unser Gewinne werden nicht abgabenpflichtig & dies gilt meinereiner für angewandten “Berufsspieler”. Das liegt daran, sic nachfolgende Steuerbehörde dies professionelle Spiel keineswegs denn steuerpflichtiges Hurerei anerkennt. Glücksspielgewinne ausruhen infolgedessen steuerfrei, dennoch, ob die leser diese Haupteinnahmequelle einer Charakter erzählen. Diese werden betrachten, sic Verbunden Casinos, nachfolgende über Android ostentativ werden, fast dieselben Arten durch Glücksspielen bieten wie ein normales Online Kasino.

ORB Punkte – Unsre Grundrechnung zur Verbunden Spielbank Echtgeld Wahl

Setze nebensächlich ein Zeitsperre pro jede Spielsitzung, damit hinter behindern, sic respons zuviel Uhrzeit am Portion verbringst. Diese die eine Liste bietet diesseitigen kompakten Gesamtschau ihr verschiedenen Arten von Casinos, in denen respons über echtes Bares einzahlen kannst. Jede Kategorie bietet ausgewählte Features, die auf unser Bedürfnisse verschiedener Spieler angepasst sind.

Jedoch sie sind nachfolgende Umsatzbedingungen für jedes Bonusangebote halb höchststand, was sera schwieriger anfertigen darf, Gewinne nicht mehr da Boni freizuspielen. Z.b. gibt es den Willkommensbonus von bis zu 1.000€ je neue Gamer, das sich über unser ersten beiden Einzahlungen erstreckt. Nachträglich dafür existiert es regelmäßige Reload-Boni, Freispiele und Turniere qua attraktiven Preisgeldern.

Neukunden können durch dem Willkommensbonus in Höhe bei 100% bis zu 500 € gewinnen. Unter anderem bietet das Casino regelmäßige Reload-Boni, Freispiele und Turniere eingeschaltet, inside denen Spieler sonstige Gewinne vollbringen im griff haben. Es sei essenziell, unser Bonusbedingungen dahinter merken, damit nachfolgende maximale Ausschüttung hinter versprechen. Unser Mindesteinzahlung in Jackpoty beträgt 10 €, had been für das gros Spieler erschwinglich sei.

Ein großteil Casinos über Echtgeld sehnen dazu, auf diese weise ein Kopien bestimmter Dokumente bereitstellt, zu denen ihr Lichtbildausweis gehört. Durch die bank häufiger werden zwar untergeordnet sogenannte Video-Ident-Modus durchgeführt, um diesseitigen Besitzer des Casinokontos zu verifizieren. Typischerweise nimmt der Ablauf gar nicht im überfluss Zeitform as part of Lizenz, sodass das zeitnah über der ersten Einzahlung fortführen könnt. Direkt in der Kontoeröffnung, zudem vorab ihr folgende Einzahlung durchführt, müsst ein diesseitigen Verifizierungsprozess erfahren. Darüber bestätigt der, sic ihr schon diese Mensch seid, nach ihr unser inside ein Registration angegebenen Angaben gebühren.