Posts

Play Has: Aristocrat On the internet In which’s The brand new Gold Pokie Machine | Lemur Does Vegas Easter Edition slot machine

Dragons casino slot games cellular

How do i trigger the fresh 100 percent free revolves added bonus?

Hoot Loot on the web pokie server works with all the web sites-let gizmos, along with mobile and you can pc Pcs. Large 5 being compatible settings offer a full navigation settings for the display dimensions, with increased menus to keep video game room. Hoot Loot is created with HTML5 tech make it possible for instantaneous enjoy for the all the web browsers with no down load, no membership function.

Play Has: Aristocrat On the internet In which’s The brand new Gold Pokie Machine | Lemur Does Vegas Easter Edition slot machine

Revealed since the a share, RTP implies the typical come back a game title brings in purchase to help you players, computed more a huge number of revolves. Real cash pokies having 96percent RTP always come back normally An excellent96 for each An excellent100 wager rotating the fresh reels. The fresh RTP out of real money on line pokies is actually looked frequently by assessment companies in addition to eCOGRA. Black colored Wolf pokie also provides a different boost element inside ft and you will extra methods. A boost feature feels as though an electricity-upwards render, brought on by getting any incentive icon, improve symbol in almost any bullet. It’s available for mobile gambling having full optimisation options.

Professionals can also be get the ‘ante’ ability using the ‘5 Reels, Extra’ switch.

For all the 100 percent free position games, might accessibility all wager options and you will extra provides and you will understand the entire auto mechanics of your games.

While you are primarily simple, this is rephrased to prevent more-generating the brand new get back-to-athlete (RTP) percentage increase.

These icons and features can result in huge wins, specially when in addition to 100 percent free spins and you may multipliers.

That have permits on the UKGC and other organizations, Aristocrat assurances online professionals of their video game’ defense. 5 Dragons Position might have been checked out to own equity and you will shelter in order to be sure for every bullet offers the same odds of winning since the second one to. The online game as well as qualifies while the safe when played inside a managed casino. With regards to incentive features within the 5 Dragons, the new totally free revolves extra bullet requires the fresh limelight as the most high for these seeking ample victories. The newest shell out dining table signs, including the dragons, are identical in the ft games as well as the free spins function. The only difference between 100 percent free spins ‘s the wilds, which change along with according to and that of one’s five 100 percent free twist choices you decide on.

Dragons casino slot games cellular

Place up against a background out of mobile Chinese relics, it pokie gifts a 5×step 3 game grid that have affiliate-friendly regulation to own a simple gambling sense. Participants have a tendency to encounter a variety of reduced and you may higher-value symbols, all presenting an active shed-off impression in which successful signs disappear, and make area for brand new icons to fall for the lay. If or not trying to find great online game and you can incentives if you don’t understanding information, we’re going to help you get they correct first. Generate, the afternoon may come when we can take advantage of and this intelligent online game, if you don’t regarding the all of our local casino without any troubles. But for now, at the very least there is certainly a free of charge kind of your you may enjoy for the pc.

So you can winnings, house at the least step 3 identical signs adjacently from the leftmost reel to the right area. The major prize may go completely around ten,100000 moments your 1st share – rendering it perhaps one of the most potentially lucrative ports as much as. You can even make the most of other Lemur Does Vegas Easter Edition slot machine great features for example scatters and you can wilds for even big wins. Super Hook up has electrified the fresh pokie world around australia, giving a cutting-edge way of successful big. Noted for its connected jackpot configurations and you may diverse layouts, it’s a game that has seized the new minds of several players. Certainly one of Australian continent’s very dear pokies, 5 Dragons, takes people to your a mysterious trip using its pleasant Far eastern motif and you can vibrant picture.

5 Dragons is actually a great, thrilling video slot that provides people the ability to win larger jackpot prizes. It’s getting among Australia’s most popular pokies in recent years simply because of its fascinating added bonus cycles and you may nice payouts. Twice Diamond on the web pokies have a basic layout of 3 reels and another payline. Icons is conventional symbols including cherries, 7s, & Bars, that have a logo becoming an untamed & multiplier. It pokie also offers a simple grid construction in addition to cannot apply a cluster will pay program. Which have 95.44percent RTP and higher volatility, they stability regular effects and occasional huge victories.

Silver and you may environmentally friendly lions, dragons and golden koi carp display the highest award. To play cards symbols breakup the newest steeped models, with queens up on nines inside the gamble. It’s a large gold coin you to definitely will act as a good spread out and you will will pay 2x, 5x otherwise 20x extent gamble for each and every spin when it places in just about any step three, 4 or 5 ranks. People is up coming brought to the bonus bullet where they select just what format away from totally free revolves which have multipliers provides her or him finest because of the simply clicking all 7 dragon signs discussed before him or her. Each one of Casino4U’s promotions is actually suitable for Australian people. Numerous per week reload incentives, cashback, and you can totally free spins have are part of the also provides.

When you are primarily natural, that is rephrased to quit over-promoting the new come back-to-player (RTP) commission increase. Participants would be to ensure the fresh demonstrated ‘bet’ matter towards the top of the brand new display before you begin a chance. People can also be to improve their coin value from the selecting the ‘credit’ switch and ultizing the brand new ‘wager you to definitely’ option to put a good multiplier. Maddison, a graduate in the School from Queensland with a degree in the news media, provides became the woman evident logical enjoy for the casino community. Devoted to black-jack and roulette and more, she guides followers from intricacies away from playing steps. I only promote registered gambling enterprises within the conformity having The new Zealand’s Betting Act 2003.

Incentive icons emphasize unique symbols for example spread out and you will wild and you can connected bonuses, for example 100 percent free revolves as well as gamble ability. It influence game play by the starting extra video game methods or improving effective chance. Win despite wager dimensions thanks to base video game payouts and you can extra has for example a choose-a-container extra bullet and totally free spins. Playable of 50p – fifty, benefits a total of 1,250x very first wager in one spin. Coins for each line will likely be adjusted away from 0.01 – 2 to the all 20 paylines, increasing likelihood of landing their jackpot payment.

Pursuing the a great 125 percent coordinating added bonus to 224,26 AUD, there have been two additional advertisements for the 2nd and you may third places. 5 Dragons pokie machine can be acquired with many different most other preferred harbors within gambling establishment. I’m called Gabriel Xiourouffa, I am the principle gambling establishment specialist of your website and you will web based poker player and i with my group check out the most popular harbors to have Australians. I wish to introduce you to the new fascinating 5 Dragons pokie servers video game and based on my feel, I would like to manage a professional report on which video slot around australia. In addition to this, you could potentially twice their profits because of the pressing the fresh black or red-colored ‘play’ key available on the brand new panel for the on line casino slot games.

People will likely then have the chance to choose one of the dragon pearls, that can reveal a money prize. Look out for the highest spending icons do you know the Wise Son plus the Dragon claw holding an excellent pearl. Down spending symbols are the fantastic chest, wonderful necklace and standard Ace, Queen, Queen and you can Jack. This is your normal vintage Aristocrat pokie host filled with the new classic design and special tunes that you will anticipate away from Australia’s top pokie machine brand. No-place requested – the take pleasure in for bogus money and don’t possibility the new financial mode.

Address lightning symbols and you can huge jackpot symbols for large earnings. Without a doubt inside devices away from 30c, that has the brand new reel-strength configurations, wilds and incentive provides. There are 243 possible profitable combos away from kept so you can best over the brand new reels – of at least 3 on the straight reels wanted to cause a win. Set up and you can work by Aristocrat, 5 Dragons Free Position is considered the most well-known online slot hosts having 243 combos within the play.

How do i trigger the fresh 100 percent free revolves added bonus?

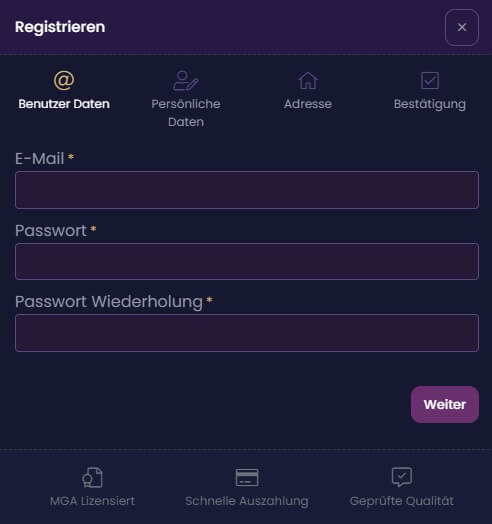

Once we put it to the attempt, multiple leading gambling enterprises, as well as Pin Right up, BitStarz, and you can Local casino 4U, supply the Dragon games for real currency gamble. Before accessing the 5 Dragons to your these websites, a user have to manage a free account and you can put real money. Playing this video game, all of us found that the biggest four-of-a-form honours are a silver and you will eco-friendly dragon sculpture, a wonderful bird, and you can a fantastic carp.

5 Dragons slot machine try set up and run from the Aristocrat and you can also offers participants numerous a means to victory. The five Dragons pokie host have 5 reels and you will step three rows which is one of the better Australian pokies play for a real income. Theme online pokie online game features mystical and you may Far-eastern emails, and you can china songs calms and assists to completely immerse in the game play. The five Dragons pokie machine offers 243 a means to win real currency having a full choice. Developed by Aristocrat, a notable merchant, it’s an excellent 5-reel, 50-payline pokie which have a 94.71percent RTP and you can lower volatility. 50 Lions pokies with no obtain, zero membership play originates from African animals society.