Nada Hassanein, Stateline.org

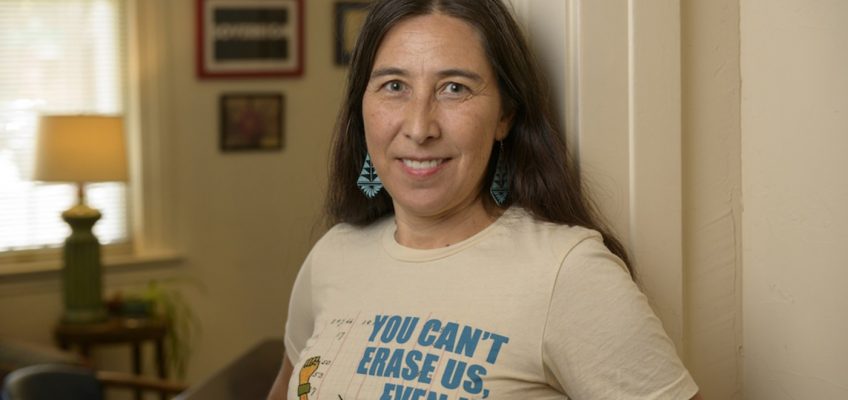

When Stephanie Russo Carroll, a citizen of the Native Village of Kluti-Kaah in Alaska, set out to earn her doctorate in tribal health 15 years ago, she focused her research on tribal cultural and health programs within six tribes.

Related Articles

Federal judge blocks Trump’s public health cuts, including $250M in Minn.

Shingles is awful, but there may be another reason to get vaccinated. It may fight dementia

Does Wordle help? Experts reveal ways keep your brain sharp

Alzheimer’s disease study: researchers create at-home smell test for early detection

Liquid eggs recalled for possible bleach contamination

She needed vital statistics data, such as birth and death rates, for each of them. But getting that data from the state, which houses vital statistics, was difficult — and in some cases, the data she needed was missing.

“Health outcomes data were unobtainable,” Carroll recalled. In one case, her team had to try using breastfeeding rates as a proxy to estimate birth rates. But even getting those for all six tribes was impossible.

For the next two decades, Carroll would continue to push for U.S. tribes — which are sovereign nations — to own and maintain control over their data, including health statistics.

The concept, known as data sovereignty, is important amid the harrowing health disparities seen in tribal people, rooted in forced assimilation dating back more than a century. Often, data gathered by and about tribes has been shared with state and federal agencies; but those same agencies haven’t always shared their tribal-related statistics in return.

The reasons vary, from systemic issues within the health care system to mistaken assumptions by some federal officials about what data be securely sent to tribes without risking privacy violations.

The lack of tribe-specific data has hindered tribes from fully taking care of their members and clouded their work on public health responses to disease outbreaks such as syphilis and COVID-19, on maternal and infant health outcomes, and on chronic issues such as diabetes, heart disease and substance use.

Data sovereignty is especially relevant now, as the Trump administration scrubs federal health websites of data that recognizes and tracks metrics among the country’s various racial and ethnic groups, including what little data there is on tribal members.

States govern their own health data systems. But the same isn’t true for the nation’s 574 federally recognized tribes.

Now an associate professor of public health at the University of Arizona, Carroll co-founded the U.S. Indigenous Data Sovereignty Network and directs the Collaboratory for Indigenous Data Governance. Both are groups that work to research and strengthen Indigenous data governance, accuracy and data-driven policy.

“If you don’t know who has been sick or hospitalized,” Carroll said, “how can you make sure you have the right care systems for your community?”

Withholding tribes’ data

As part of its slashing of diversity, equity and inclusion initiatives, the Trump administration removed numerous racial, ethnic, adolescent and maternal health datasets from the websites of several federal agencies, including the Centers for Disease Control and Prevention. While some of the data has been reinstated, the swift deletions raised alarms in tribal communities.

Abigail Echo-Hawk, a member of the Pawnee Nation of Oklahoma and director of the Urban Indian Health Institute, said the youth behavioral risk surveys were reinstated, but were missing key race and ethnicity search features that tribes use to track mental health conditions in American Indian and Alaska Native teens.

“Now, we can’t search, disaggregate by Native youth,” she said. “That information is about our children, and it is the legal right of both now the tribal epidemiology centers and the tribes to have access to that previously gathered information.”

Abigail Echo-Hawk, of the Pawnee Nation of Oklahoma and director of the Urban Indian Health Institute, poses for a photo at a maternal mental health forum in Washington, D.C., this month. (Nada Hassanein/Stateline/TNS)

Despite their public health authority, tribes and tribal epidemiology centers, which support tribes with health data tracking, say federal and state health officials have long withheld or denied requests to direct access of health data related to their tribes, including coronavirus data during the pandemic.

Such data is tied to treaty rights obligations and shouldn’t be lumped together with diversity, equity and inclusion initiatives currently under attack by the Trump administration, Echo-Hawk said.

“Our treaty rights are tied to having information around tribal people. So, if you’re going to uphold our treaty rights, you need to say: ‘This number of Native people are experiencing this issue,’ or ‘This number of Native people exist,’” she said.

It wasn’t until 2021 that the CDC conducted its first comprehensive life expectancy profile of American Indians and Alaska Natives; it showed that in 2019, their life expectancy was seven years lower than that of white people.

“All of the data is a story. It’s a grandmother, it’s a son, it’s a story of a community’s well-being,” Echo-Hawk said.

When tribes receive federal grants — whether for transportation, housing or education initiatives — there are grant reporting requirements.

Under those rules, tribes send raw data to federal agencies, but they often don’t get that data back, said social demographer Desi Small-Rodriguez, an assistant professor of sociology and American Indian studies at the University of California, Los Angeles, who co-founded the data sovereignty network with Carroll.

“It’s a one-way data highway coming from tribal governments — leaving tribal governments and going into the feds — and it’s not coming back,” said Small-Rodriguez. She also directs the Data Warriors Lab, working with tribes — including her own Northern Cheyenne Tribe of Montana — to develop legal mechanisms to ensure data ownership.

She said the federal government should provide funding, as part of its treaty obligations, to pay for expensive data support such as secure storage systems, high-performance computers and analytics staff.

“As part of our treaty rights, we have a right to health care and education. We have a right to clean water and air — and data form the basis for all of that,” she said.

State data agreements

In January, the Tulalip Tribes in northwest Washington state secured a data-sharing agreement with the state department of health. It gives the tribes access to the state’s disease reporting system, allowing them to extract some data directly. Tulalip plans to eventually secure access to more datasets.

It’s the first agreement of its kind in the state, said Summer Hammons, legislative policy analyst in the Treaty Rights and Governmental Affairs Department of the Tulalip Tribes, which has at least 5,000 members. Hammons grew up on the reservation.

She hopes it will help the tribe direct resources and funds where they’re needed — whether it’s more cancer screenings or vaccinations against diseases such as measles, as other states grapple with outbreaks of the virus.

“It allows us to collaborate and lead on outbreak investigations related to tribal members,” Hammons said. “It’s a clear outline that tribes own their data in partnership with the state, because the state’s the one that’s collecting it. But we want to tell our story, and we want to be able to work with DOH [department of health] to be mindful of our stories and to also get better access to the statistics.”

A few other states — Alaska, Arizona, Oregon and South Dakota — also have limited-scope agreements with tribes.

Gary Ferguson, Unangax (Aleut), is the director of integrative medicine at Tulalip Health Clinic. He said he hopes the data will help the tribe track health care interventions over time.

“We don’t know what’s working. We don’t know what’s not working,” he said. “We want to celebrate our wins.”

Tracking disease

In recent years, the nation has seen alarming surges in congenital syphilis, a preventable infection passed through pregnancy to newborns. Nearly 40% can be stillborn or die as a newborn. Babies can also suffer lifelong blindness or deafness. Tribal babies suffer the highest rate.

Officials at the Great Plains Tribal Epidemiology Center, which tracks tribal public health across four states, were denied syphilis data from local public health departments for years until the group leaned on the CDC for assistance.

It wasn’t until then that, finally, last year, one state — South Dakota — agreed to share American Indian and Alaska Native syphilis cases as soon as they’re reported, said Sarah Shewbrooks, the group’s lead tribal epidemiologist.

Shewbrooks hopes the access in South Dakota will pave the way for more agreements in the other Great Plains states.

‘We needed this yesterday’

During COVID-19, American Indian and Alaska Native people were more likely to be infected and compared with white people, had double the risk of in-hospital death and three times the rate of severe infection, research shows. Yet even then, data weren’t telling the whole story.

Echo-Hawk’s organization published a report card in 2021 that scored each state’s collection of Natives’ COVID-19 cases. In total, the nation averaged a D+. This year, she published a follow-up for epidemiologists on addressing the misclassification of Native people, who often are listed as “white” or “Hispanic” in health settings and death certificates. Many states also inconsistently or don’t report tribal affiliation on death certificates, which can make tribe-specific death rates elusive.

A report in 2021 from the nonpartisan U.S. Government Accountability Office found that some officials from the CDC and the Indian Health Services agency didn’t recognize that they were required by law to share data with tribal epidemiology centers, the centers told investigators.

In the GAO report, investigators detailed logistical barriers, including federal agencies’ reluctance to share COVID-19 data because of concerns around privacy and security in data transmission.

“This is one of the best examples of what structural racism looks like,” said Shewbrooks. “Because when you look at the infrastructure for public health systems and public health data, tribes and [tribal epidemiology centers] were never included in that infrastructure.

“COVID really put it up there as: No, we needed this yesterday.”

Shewbrooks said that as part of her work she’d go to funeral directors, who may fill out death certificates, throughout the region to educate them on proper classification of American Indian people. “I even had one say to me once, ‘I just always code them by how they look. I never ask what their race is.’”

“A lot of them didn’t know that this is data that gets really used,” she said. “Vital records data is just super important, foundational work in a lot of epidemiological work.”

There is no national standard for tribal health data, explained Cheryl Ellenwood, who is a citizen of the Nez Perce Nation and also Diné (Navajo).

Ellenwood, an assistant professor in Washington State University’s School of Politics, Philosophy and Public Affairs, experienced firsthand the data disconnect when both her parents died of COVID-19.

Four years ago, her mother, Annie Benally Ellenwood, an enrolled Navajo tribal member from New Mexico, died at age 71 in a hospital in Idaho. Annie Ellenwood’s death, however, wouldn’t show up in primary statistics of COVID-19 deaths in Navajo people — her tribe isn’t listed on her death certificate.

“I was very hurt by this, because my mother died because of COVID-19, and I wanted her death to count and mean something,” Ellenwood said.

“It still feels very life and death, like we are fighting to demonstrate the impact of so many things on our people,” she said.

Stateline reporter Nada Hassanein can be reached at nhassanein@stateline.org.

Stateline is part of States Newsroom, a national nonprofit news organization focused on state policy.

©2025 States Newsroom. Visit at stateline.org. Distributed by Tribune Content Agency, LLC.