By MARC LEVY

HARRISBURG, Pa. (AP) — As outrage spreads over energy-hungry data centers, politicians from President Donald Trump to local lawmakers have found rare bipartisan agreement over insisting that tech companies — and not regular people — must foot the bill for the exorbitant amount of electricity required for artificial intelligence.

Related Articles

Trump’s Fort Bragg visit will spotlight special forces who captured Venezuela’s Maduro

Justice Department sues Harvard for data as it investigates how race factors into admissions

Public health workers are quitting over assignments to Guantánamo

Trump boasts of over $1.5B in political funds. How he chooses to spend it could rock the midterms

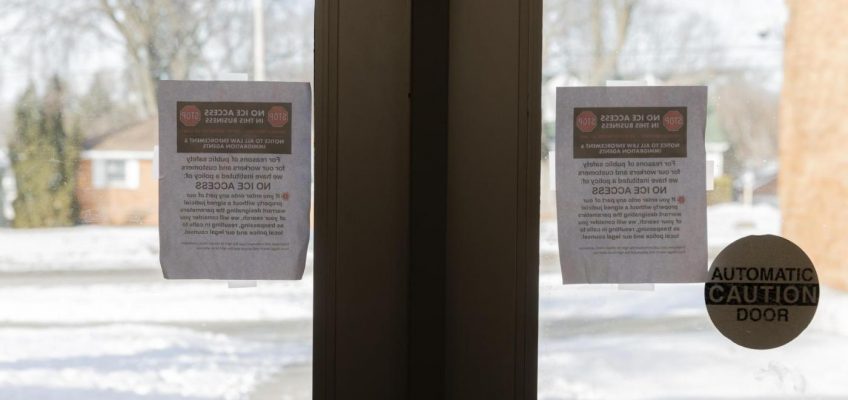

Teachers describe immigration enforcement’s impact on classrooms in challenge of Trump policy

But that might be where the agreement ends.

The price of powering data centers has become deeply intertwined with concerns over the cost of living, a dominant issue in the upcoming midterm elections that will determine control of Congress and governors’ offices.

Some efforts to address the challenge may be coming too late, with energy costs on the rise. And even though tech giants are pledging to pay their “fair share,” there’s little consensus on what that means.

“‘Fair share’ is a pretty squishy term, and so it’s something that the industry likes to say because ‘fair’ can mean different things to different people,” said Ari Peskoe, who directs the Electricity Law Initiative at Harvard University.

It’s a shift from last year, when states worked to woo massive data center projects and Trump directed his administration to do everything it could to get them electricity. Now there’s a backlash as towns fight data center projects and some utilities’ electricity bills have risen quickly.

Anger over the issue has already had electoral consequences, with Democrats ousting two Republicans from Georgia’s utility regulatory commission in November.

“Voters are already connecting the experience of these facilities with their electricity costs and they’re going to increasingly want to know how government is going to navigate that,” said Christopher Borick, a pollster and director of the Muhlenberg College Institute of Public Opinion.

Energy race stokes concerns

Data centers are sprouting across the U.S., as tech giants scramble to meet worldwide demand for chatbots and other generative AI products that require large amounts of computing power to train and operate.

The buildings look like giant warehouses, some dwarfing the footprints of factories and stadiums. Some need more power than a small city, more than any utility has ever supplied to a single user, setting off a race to build more power plants.

The demand for electricity can have a ripple effect that raises prices for everyone else. For example, if utilities build more power plants or transmission lines to serve them, the cost can be spread across all ratepayers.

Concerns have dovetailed with broader questions about the cost of living, as well as fears about the powerful influence of tech companies and the impact of artificial intelligence.

Trump continues to embrace artificial intelligence as a top economic and national security priority, although he seemed to acknowledge the backlash last month by posting on social media that data centers “must ‘pay their own way.’”

At other times, he has brushed concerns aside, declaring that tech giants are building their own power plants, and Energy Secretary Chris Wright contends that data centers don’t inflate electricity bills — disputing what consumer advocates and independent analysts say.

States moving to regulate

Some states and utilities have started to identify ways to get data centers to pay for their costs.

They’ve required tech companies to buy electricity in long-term contracts, pay for the power plants and transmission upgrades they need and make big down payments in case they go belly-up or decide later they don’t need as much electricity.

FILE – High-voltage transmission lines provide electricity to data centers in Ashburn in Loudon County, Virginia, on July 16, 2023. (AP Photo/Ted Shaffrey, File)

But it might be more complicated than that. Those rules can’t fix the short-term problem of ravenous demand for electricity that is outpacing the speed of power plant construction, analysts say.

“What do you do when Big Tech, because of the very profitable nature of these data centers, can simply outbid grandma for power in the short run?” Abe Silverman, a former utility regulatory lawyer and an energy researcher at Johns Hopkins University. “That is, I think, going to be the real challenge.”

Some consumer advocates say tech companies’ fair share should also include the rising cost of electricity, grid equipment or natural gas that’s driven by their demand.

In Oregon, which passed a law to protect smaller ratepayers from data centers’ power costs, a consumer advocacy group is jousting with the state’s largest utility, Portland General Electric, over its plan on how to do that.

Meanwhile, consumer advocates in various states — including Indiana, Georgia and Missouri — are warning that utilities could foist the cost of data center-driven buildouts onto regular ratepayers there.

Pushback from lawmakers, governors

Utilities have pledged to ensure electric rates are fair. But in some places it may be too late.

For instance, in the mid-Atlantic grid territory from New Jersey to Illinois, consumer advocates and analysts have pegged billions of dollars in rate increases hitting the bills of regular Americans on data center demand.

Legislation, meanwhile, is flooding into Congress and statehouses to regulate data centers.

Democrats’ bills in Congress await Republican cosponsors, while lawmakers in a number of states are floating moratoriums on new data centers, drafting rules for regulators to shield regular ratepayers and targeting data center tax breaks and utility profits.

Governors — including some who worked to recruit data centers to their states — are increasingly talking tough.

Arizona Gov. Katie Hobbs, a Democrat running for reelection this year, wants to impose a penny-a-gallon water fee on data centers and get rid of the sales tax exemption there that most states offer data centers. She called it a $38 million “corporate handout.”

“It’s time we make the booming data center industry work for the people of our state, rather than the other way around,” she said in her state-of-the-state address.

FILE – People opposed to a data center proposal at the former Pennhurst state hospital grounds talk during a break in an East Vincent Township supervisors meeting, Dec. 17, 2025, in Spring City, Pa. (AP Photo/Marc Levy, file)

Blame for rising energy costs

Energy costs are projected to keep rising in 2026.

Republicans in Washington are pointing the finger at liberal state energy policies that favor renewable energy, suggesting they have driven up transmission costs and frayed supply by blocking fossil fuels.

“Americans are not paying higher prices because of data centers. There’s a perception there, and I get the perception, but it’s not actually true,” said Wright, Trump’s energy secretary, at a news conference earlier this month.

The struggle to assign blame was on display last week at a four-hour U.S. House subcommittee hearing with members of the Federal Energy Regulatory Commission.

Republicans encouraged FERC members to speed up natural gas pipeline construction while Democrats defended renewable energy and urged FERC to limit utility profits and protect residential ratepayers from data center costs.

FERC’s chair, Laura Swett, told Rep. Greg Landsman, D-Ohio, that she believes data center operators are willing to cover their costs and understand that it’s important to have community support.

“That’s not been our experience,” Landsman responded, saying projects in his district are getting tax breaks, sidestepping community opposition and costing people money. “Ultimately, I think we have to get to a place where they pay everything.”

Follow Marc Levy on X at: https://x.com/timelywriter