When a land forgets its legends,

Sees but falsehoods in the past,

When a nation views its sires

In the light of fools and liars—

’Tis a sign of its decline,

And its glories cannot last.

Branches that but blight their roots

Yield no sap for lasting fruit.

During the spring of 2023, members of the Texas State Historical Association (TSHA) gathered in El Paso for their 127th annual meeting. When attendees opened their programs, they found the epigraphic poem above tattooed in the middle of the welcome letter composed by the organization’s executive director, J.P. Bryan—an unwavering traditionalist and the former CEO of the multimillion-dollar company Torch Energy Advisors.

If the century-old poem appeared out of place for an event that celebrated intellectual inquiry, his statement of two seemingly contradictory goals was even more inexplicable. One expressed the hope “that the above statement of possibility does not become reality in the teaching of Texas history,” the other “that our organization is assured of its rightful calling as the finest state historical organization in this country.”

The field, of course, cannot have it both ways. University-trained scholars concern themselves with the writing of history that, ideally, examines the past through historical methods designed to find meaning in it; the other side, the one Bryan is on, draws sustenance from the traditional narratives that instill Lone Star pride.

The traditional chronicle of history that Bryan championed celebrated the process by which “true Texans” wrested the land from “the wilderness, the Indians, and the Mexicans,” as T.R. Fehrenbach articulated decades ago. The overarching idea, an instinctive metanarrative of “right by might,” formed the bedrock for a mostly 19th-century view of a martial past that average Texans seldom questioned. Its originators decided to pursue a narrative arc emphasizing the Texas Revolution and the state’s Western heritage, pushing the Civil War into the background.

As the rest of the former Confederate states continued wallowing in the ennobling aura of the Lost Cause, Texans freed themselves from such saturnine debilities on account of their triumphant role in the “winning of the West.”

It was not until the last quarter of the 20th century that professional academic historians began bringing to bear the established methodologies of university training to their studies of the Texas past. The two sides were formally defined in 1990, when Texas A&M professors Robert Calvert and Walter Buenger published Texas History and the Move into the Twenty-First Century. Introducing new concepts that challenged the heavy-handed master narrative of the victors’ tale, these research historians effectively declared a rhetorical war on the conventionalcanon.

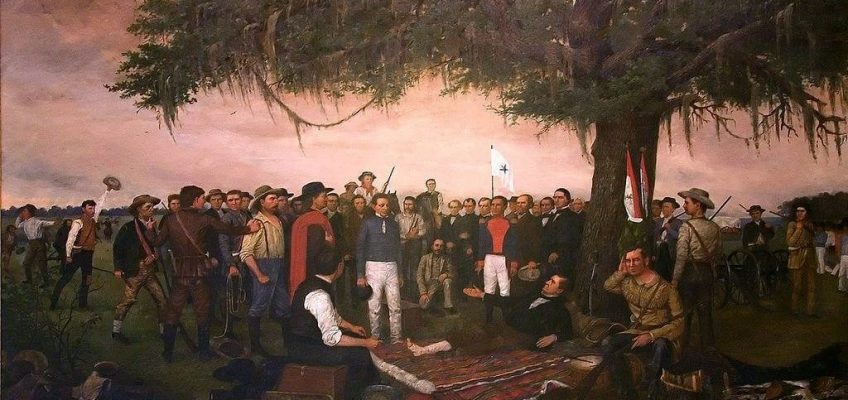

William Henry Huddle’s 19th-century painting “The Surrender of Santa Anna,” which is displayed at the Texas Capitol, depicts a key moment in the victors’ version of state history. (Wikipedia Commons)

The pioneering work by this new generation of social historians viewed society from the bottom up, focusing on the lives of ordinary Texans and their experiences. They made clear that the questions university-trained historians asked about the past, and the research required to provide the answers, contrasted in scope, focus, orientation, and conclusions with the public memories and myths held by traditionalists.

Given the impasse between the two sides, the field of Texas history looked precarious, yet everything appeared to be lining up exactly the way the writing of history is supposed to work. There was orthodoxy—the traditional history—butting heads with the antithesis, academic scholarship. Because of their willful detachment from traditional history, however, research historians never made an effort to execute the third step in what should have been a logical triad: creating a new orthodoxy.

Scholars never invested the intellectual capital necessary to convince laypeople such as Bryan—at least in a way that penetrated the anger-armor of their insecurities—that a society becoming critical of its legends represents the first step toward rehabilitating a more complex story by taking on shades of gray that make their narratives real and more important. Rather than deconstruct it in a way that would educate its casual enthusiasts, scholars mostly ignored traditional history outside of revisionist and whiteness studies. The long game that research historians played depended on the impractical approach of waiting out the natural death of the traditional narrative, a creation story of frontier exceptionalism that was baked into the Texan identity.

When traditionalists began openly attacking academic scholarship, research historians stayed the course of maintaining separate spheres, refusing even to try setting them straight. When the rhetorical war came, signaled by the poem Bryan introduced at the TSHA’s annual conference, traditionalists punctuated their attacks on academic history with open hostility built up during three decades of scholarship they did not understand. A heated exchange between Bryan and progressive-minded historians over his provocative ode to traditionalism revealed the intellectual distance that separated the two sides from any measure of understanding.

The immediate controversy that the vintage poem stirred up impelled Bryan to avow, “I don’t like their history, and I don’t believe their history.” He continued by insisting that in the version he embraces, westward Anglo expansion and the founding of Texas had the effect of “spreading freedoms for all.” The incendiary declaration was rebutted in an open letter, signed by 10 past TSHA presidents, who asked how Bryan, a proud descendant of Texan founding father Stephen F. Austin through a nephew, could “seriously contend that his pioneer great-great-grandfather settled on his Brazoria County plantation with thirty-eight slaves in order to secure ‘freedoms for all.’”

Actually, that is such an easy question to answer that it raises reservations about the interpretive clarity scholars brought to the table in this culture war. Given a traditionalist narrative that extolled the violent taking of the land, how else could their society be sustained than at the expense of everyone who was not Anglo and male?

The tone of Bryan’s machinations found a kindred pairing with the creation of the Texas History Trust (THT), which began producing provocative videos condemning progressive scholarship. Michelle Haas, a TSHA member and editor of Copano Bay Press, narrated for THT the brief series “unMakers of Texas History.” Her combative style vilified the work of progressive scholars, even singling out some leading Texas historians for mocking derision.

For people such as Haas, Bryan, and their close supporters, this contest with progressive-leaning scholars was not about understanding the past; it was about power and keeping their soldiers on their side of the rhetorical battle lines.

When Haas pilloried Buenger, then- chief historian of the TSHA, Buenger responded in part by suggesting that “historians stay humble [and] avoid treating those who seem wrong-headed with disdain.” Rather than pushing back or waiting out the interregnum, scholars began dropping their memberships in the TSHA, effectively surrendering the institutional machinery of the state’s historical organization to traditionalists.

The defections had become so numerous by the fall of 2023 that Ben Johnson, a Loyola professor and former board member of the TSHA, polled like-minded Texas historians about the possibility of forming a counter-organization. The overwhelming response resulted in the creation of the Alliance for Texas History, which also attracted enthusiasts who would maintain memberships in both bodies. That next spring, on April 28, members of the Alliance gathered at Texas Christian University (TCU) in Fort Worth, where they held a one-day symposium at a small but sold-out auditorium. Gregg Cantrell, a highly regarded Texas historian who held an endowed chair at TCU, lent his prestige to the organization by becoming its interim president. The meeting’s success led to organizing a full conference that met this spring as well as a call for papers to be published in a new scholarly journal.

Even before traditionalists commandeered the state’s primary historical organization in 2023, two other groups had already launched endeavors to reshape the narrative of the state’s past. The first,the conservative Texas Public Policy Foundation (TPPF), initiated the so-called 1836 Project. The title signified a conservative response to the liberal 1619 Project, introduced in 2019 by journalists, historians, and artists who sought to reframe a new national narrative around slavery and its lingering influence. Hearkening to the year of Texas independence from Mexico, the stated purpose of the 1836 Project was to establish “an advisory committee to promote patriotic education and increase awareness of the Texas values that continue to stimulate boundless prosperity across this state.”

The work of TPPF found consonance in another methodical undertaking, the Texas Center at Schreiner University in Kerrville, founded in 2020. Its mission proposed to foster “dialogue and understanding among Texans from all walks of life.” To guide the enterprise, the center selected Don Frazier, a “narrative historian” and TCU Ph.D. who had earlier organized and managed the McWhiney Foundation, which featured the State House Press, dedicated to publishing scholarly books with a traditionalist approach to history.

As TPPF and the Texas Center competed with real scholarship, the hard-right turn signaled by the 2024 elections turbocharged challenges to academic history in Texas. Soon, new state policies assailed programs that valued diversity, equity, and inclusion in the workplace. In May, Governor Greg Abbott signed into law Senate Bill 37, which shifts the power to make hiring and curriculum decisions away from faculty and toward state-appointed governing boards. Scholars are also contending with a more general, interpretive assault on their work embodied in President Donald Trump’s recent executive order “Restoring Truth and Sanity to American History.”

If these provocative actions caught scholars flat-footed, yet another challenge to the work of research historians is taking shape. Just as a committee of Texans during the 1930s anticipated their centennial by manufacturing an enduring master narrative, traditionalists today seem to be preparing for the 2036 bicentennial by retooling their grand thesis to fit present-day conditions. The dismissive contempt that university-trained scholars have expressed for the 1836 Project and the Texas Center seems to have left them unmindful of an interpretive sea change. Traditionalists have expanded the scope of their history, venturing beyond the state’s formative development and into the present age. Driving their conservative efforts is a sweeping but narrow reinterpretation of the Texas past: Sanitized—and deceptively less whitened—it proposes that “Texas history presents a record of opportunities and obstacles.”

Such a perspective maintains the equation of celebrating Texas history rather than seeking understanding. It can spotlight someone such as post-WWI-era pilot Bessie Coleman and imply that being Black and a woman were merely obstacles standing in the way of her achievements. This kind of approach recasts the oppressive depth of social, economic, and political inequities as surmountable barriers, minimizing the more injurious experiences for others subjugated by systemic institutional injustice.

This anecdotal approach that views Texas history as “a record of opportunities and obstacles,” however, does little to help us truly understand who present-day Texans are becoming as a people. At a time of epochal transition, that can be done only by placing the history of Texans excised from the traditional history in the center of the narrative. These include Texans of color, women of every ethnicity, and even Anglo men whose ideas, values, or associations placed them at odds with the ruling order. Such a construction is a necessary part of the process to reach an even more expansive view of the past. And it is one that works against the interests of traditionalists and the power elite.

Robert J. Onderdonk’s 1903 “The Fall of the Alamo,” which is displayed in the governor’s mansion, depicts a heroic, rifle-wielding Davy Crockett in line with traditionalist Texas history. (Wikipedia)

So, what then is the outlook for the near future of Texas history? The progressive tide that swept American society circa 2020 has been beaten back; even so, the minute that progressive scholars today begin to acknowledge the impediments that allowed traditionalists to overtake them, the path ahead will open.

Seven years ago, I argued that “without piecing together grand narratives—which, although imperfect, at least include as a feature a broad understanding of how constructs of power and language are manufactured and at what costs their proponents maintain them—progressive scholars might as well retreat into those cavernous halls of academe, where they can write discourses for consumption by likeminded colleagues. Wider audiences … will never be the wiser.” What was intended as exaggerated anxiety ended up coming into view when so many academics dropped their memberships in the TSHA and created the Alliance for Texas History.

Their dramatic exodus has diminished the work of the TSHA, and—for better or worse—the intellectual well-being of the field itself now rides on the fate of the Alliance. Whether this ends up representing a strategic retreat for academics or an admission of failure will depend on the way thinking people in this contest respond to this moment in time. Will scholars learn from their past mistakes, and will open-minded workaday Texans listen if they do?

Those who would establish a new usable past that informs both sides must exercise a degree of intellectual humility that balances the popular needs and sensitivities of traditionalists who want to celebrate the historical journey and the demanding obligations of scholarship that looks critically for meaning along every step of the way. After 35 years of giving traditionalists scant attention, getting the general public to this balanced place will involve a steep learning curve. Such a difficult reckoning will not come soon. But there is no other suitable way forward.

The post How Scholars Lost the Culture War over Texas History appeared first on The Texas Observer.