What a nice coincidence. Three St. Paul authors (and one from West St. Paul) are launching their new books this week. Enjoy their eclectic fiction, including short stories, thrillers, and a novel set in the milieu of fonts and typefaces.

(Courtesy of the author)

Let’s begin with a novel a decade in the making.

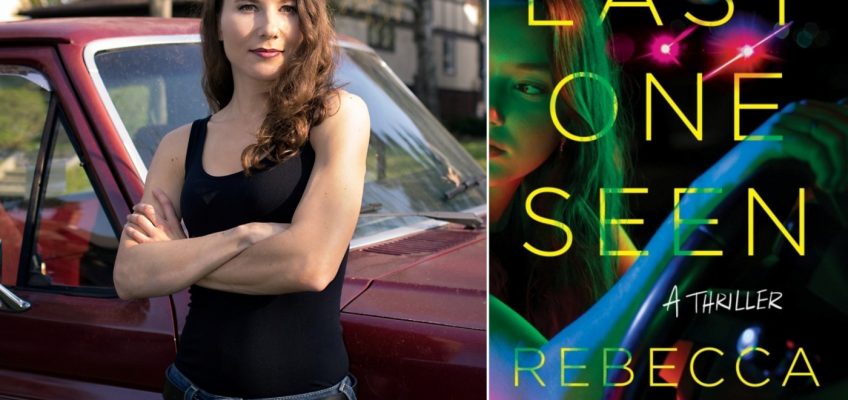

Rebecca Kanner came home from Bouchercon World Mystery Convention in New Orleans this month happy that her debut psychological thriller, “Last One Seen,” earned her a place on a panel about writing in this genre that is new to her.

“It was fun to go to Bouchercon and fun to return,” Kanner said during a phone conversation from the home she shares in Highland Park with her father, Michael.

Kanner’s previous novels — “Esther,” about Queen Esther who saved her Jewish people, and “Sinners and the Sea,” a story of Noah’s wife — earned critics’ praise. Jumping from the Old Testament to thriller territory was a gamble that has paid off for this writer who put some of her life into her new novel.

“It’s hard to genre jump,” she says. “Publishers are conservative. They want you to say the same things over and over. A thriller felt so natural to me, being in an MFA program and having a mood disorder. The novel ended up taking me 10 years off and on, doing projects in between. It felt like I had all this material and when I thought about how to organize it, the mystery format seemed to work.”

In “Last One Seen,” we meet Hannah, who’s just joined the MFA writing program at Washington University in St. Louis, where she makes friends among the tight-knit group of post-grads. But Hannah is not well mentally.

“Hannah struggles,” Kanner explains. “She has bipolar disorder. People see that as something negative. But for an artist it is kind of powerful. Should she medicate away all this energy? Can she walk a line with meds that keeps the good stuff from bipolar and tap down the bad stuff? Lots of artists struggle with bipolar disorder, and (the energy) feels like magic.”

The story, which explores the line between perception and reality, begins with Hannah being driven north of the Twin Cities. She doesn’t know how she got in the car or where she is going. She only knows that her friend Justine was killed and that there are three suspects, one of them herself. Hannah is an unreliable narrator not only because she has mental issues but also because she skips her meds and drinks until she passes out. So she has big gaps in her memory. At first, she hated Justine for being sophisticated and glamorous, as well as taking the last fellowship with a stipend. But Justine wanted to be Hannah’s best friend. Is she? Why does sexy Eli, who swears he loves Hannah, ply her with drinks? Is Hannah being psychologically manipulated? Who can she trust?

Rebecca Kanner (Courtesy of the author)

The novel’s characters, Kanner says, are a composite of people she encountered during her MFA years at Washington University, where she learned to love writing. Included in the plot is life in academia – competition for funding and awards, vulnerability of students when their writing is workshopped, discussions about “truth” in fiction and nonfiction.

Kanner’s road to writing “Last One Seen” was winding and challenging.

“I was writing a novel about two women who were slaves in Egypt,” she recalls. “Then my apartment was broken into, my laptop was stolen, and it kind of took the wind out of my sails. I decided to switch to mysteries, which I’ve always liked because they represent true escapism. Then I went to a craft talk at the Loft by Richard Thompson (a Minnesota Book Award winner). And another woman and I studied mystery writing with him. When I showed him this really long novel I’d been working on since grad school, he said at each of our meetings, ‘I don’t want to see this again.’ Thank God he did or I’d still be working on it.”

When Kanner isn’t writing, she spends time with John Weber, whom she calls “my man John, so funny, so wonderful, the love of my life.” Weber runs Black Spur Labradors, a small breeding operation in Prior Lake, where Kanner recently watched the birth of eight pups with a surprise ninth coming later. She had fun photographing and playing with the fat little fur balls before they went to forever homes.

Now Kanner is looking forward to bringing “Last One Seen” to readers. She will launch her thriller (Crooked Lane Books, $29.99) at 6:30 p.m. Tuesday at Once Upon a Crime, 604 W. 26th St., Mpls.

“Escapes and Other Stories”: by Susan Koefod (Calumet Editions, $16.99)

At the end of the first year, though she tried hard to ignore it, the resentment began to build for his staying alive. He had never said an unkind thing to her, but his cruel going on tortured her and fed her guilt. Eventually, she accepted that she would have to kill him to be able to go on herself.” — from “Escapes and Other Stories”

Susan Koefod (Courtesy of Calumet Editions)

Everyone in the 15 stories that make up Koefod’s inventive new collection are trying to escape or have done so, from a woman who escaped through death and lies thinking in her coffin, to a mother whose identity is lost in mental hospital records.

Two of the stories are set in St. Paul. In one, sort of a fantasy, a beautiful woman comes out of an ice sculpture carved during the St. Paul Winter Carnival. In another, a mysterious guest turns up at the 1922 Bad Luck Ball hosted by Scott and Zelda Fitzgerald at the University Club.

Koefod, author of three crime novels featuring Arno Thorson, introduces the alcoholic detective in two stories: one about him defending his mother’s sad old house from kid vandals, the other about a crime at the Minnesota State Fair involving a boy who loves his big bull.

(Courtesy of Calumet Editions)

There’s a couple who play a game involving elephant jokes, a sort-of fairytale about a family and their bizarre house, a perfect crime involving a garage door opener, and another about a little girl who lays her head next to her Grandpa lying in his coffin so she can see the world through his glasses. There’s also a motorcycle-riding nun who believes she met Jesus in a carnival funhouse mirror, leading to drastic happenings in her convent.

A resident of West St. Paul, Koefod most recently published “Albert Park: A Memoir in Lies,” about a baby found at the tiny park at Bernard Street and Dodd Road. Her first Thorson novel, “Washed Up” (2011), was described by Library Journal as “a smashing debut with astute observations and gorgeous prose.” She is the winner of a $25,000 Loft McKnight Artist Fellowship.

Koefod will launch her book at 3 p.m. Saturday at Amore Coffee, 879 S. Smith Ave., West St. Paul.

“Seven for a Secret”: by Mary E. Roach (Hyperion, $18.99)

The dead of this forest have not rested, not since they were dragged to their grave screaming and begging. And now the dead have come for those who were silent when they should have spoken, for those who stood still when they have gone looking. — from “Seven for a Secret”

Mary E. Roach (Courtesy of the author)

It was called Sister’s Place, in the town of Avan Island, Md., a group home for girls that nobody wanted. Ten-year-old Nev, the youngest, was there when seven of her sisters disappeared. She was also taken, the only one who got away from the monster with a bloody saw in a shack in the woods.

So begins Roach’s second, beautifully written young adult thriller about female rage, grief, revenge, the power of men to make a little girl feel small, and sense of family among residents of Sister’s Place.

Nev, who’s now 17 and emancipated, returns to Avan Island. It’s been five years since she left, years spent learning martial arts and becoming a sharp-edged woman who wants to find out why the town’s leading men are being killed, including the police chief, the pastor who “counseled” the girls and others who served on the board of Sister’s Place. These were the men who wouldn’t listen to Nev and her sisters when they tried to talk about the disappearance of the other girls. The men dismissed them, saying the disappeared were runaways and “girls like that” were liars.

At the island, Nev meets gentle, smart Roan, one of the oldest girls who lived at Sister’s Place. Roan, who also wants answers about their vanished sisters, is a reporter for a small newspaper investigating the deaths of the prominent men, soon linked.to the girls who vanished. Nev tags along, her anger so vast it sometimes overwhelms her. There are also three other women from the group home who are in the medical field and have access to the men’s corpses. They learn there are messages cut into the bodies that make sense when Nev discovers an old book of rhymes in the abandoned Sister’s Place house that begins “One for sorrow” and ends with “seven for…”

(Courtesy of the author)

The story is told in the voices of Nev and the ghosts of her dead sisters. They know who the killer is, and this time they will make the authorities listen. It’s nearly impossible to convey the sense of horror underneath the plot. That’s what makes this such a perfect thriller. Although the Sister’s Place girls who disappeared met horrific deaths, Roach conveys this with innuendo and Nev’s dark memories without going into specifics.

As Nev, Roan and the other Sister’s Place survivors get closer to the truth, they are in more danger from whoever wants the secrets of the dead kept hidden in the forest. If they stay together, can they end the deaths?

Roach, a former teacher whose previous YA novel is “Better Left Buried,” was set to launch her new book this week at Red Balloon Bookshop on Grand Avenue in St. Paul, but the event has been postponed. Watch for updates at redballoonbookshop.com/events. She will read Oct 18 at Once Upon a Crime mystery bookshop, 604 W. 26th St., Mpls., and Oct. 24 at Barnes & Noble in Edina.

“Cyan Magenta Yellow Black”: by Kevin Fenton (Black Lawrence Press, $25.95)

Agencies are rivers of information: notes, creative briefs, white boards filled with the aftermath of brainstorms, sketches, concept boards, pink while-you-were-out slips, drafts, drafts flagged with post-its and scrawled with marginalia, estimates, time-lines, proposals, slide shows, color separations which magically constitute the world from cyan, magenta, yellow, and black, proofs, samples. Agencies are a swirl of things becoming better things. — from “Cyan Magenta Yellow Black”

When two critics, including former University of Minnesota professor Charles Baxter, describe a book as “beautiful,” you know it’s worth reading. Fenton has given us an uplifting, very St. Paul story in his third book.

Kevin Fenton Courtesy of the author)

The main character is Duane, living in St. Paul in 1993, just before computers caught on. He’s in advertising, specializing in graphic design, so throughout the story we get his thoughts on typefaces, how print ads work and how the business is changing to a more in-your-face punk style. And always he ponders use of colors all around him, from cereal boxes to magazines. He can’t help thinking about words turned into graphics, as when he visualizes “going to the Clinique counter at Dayton’s and buying glossy and luxurious shaving cream in tubes of restrained gray with sans serif type.”

When the story begins, Duane is waiting out a yearlong noncompete clause after his advertising firm’s partners ask him to leave because he refuses to bow to the wishes of clients. He is lonely, spending time in Grand Avenue coffee shops and businesses that no longer exist, including the Bibelot Shop and Table of Contents, a restaurant that shared space with David Unowsky’s Hungry Mind bookstore.

(Courtesy of the author)

Duane’s only consistent activity is attending group therapy, where he makes friends with Emily, a spritzer at the perfume counter of St. Paul Dayton’s, and Porter, a lonely and guilt-filled Vietnam vet who delivers pizza, the only job at which he never killed anyone. When Duane, Emily and Porter get together, they feel less lonely. Emmy, who keeps her social distance, decides to have her first-ever party, and Porter falls in love with a dog. Duane, whose girlfriend left him when he had a job because he was so self-centered, reconnects with her, and they resume their tender relationship. These are good people struggling to find their best lives. The reader roots for them as they look to happy futures.

Fenton is the author of “Merit Badges,” winner of the Association of Writers & Writing Programs prize for the novel, and “Leaving Rollingstone,” described by award-winning St. Paul writer Patricia Hampl as “the most important memoir to come out of the Midwest (or anywhere) in years.” His essays on advertising design have appeared in publications in the U.S. and Europe. A graduate of the University of Minnesota law school and MFA writing program, Fenton will introduce his new book at 6 p.m. Thursday at Next Chapter Booksellers, 38 S. Snelling Ave., St. Paul.

Books for fall 2025: Luigi, Ozzy and the great beyond

Readers and writers: A top-notch crime thriller leads off these fall gems

Literary calendar for week of Sept. 14

Author hopes ‘deep map’ of the St. Croix River watershed will inspire others

Jennifer Givhan’s ‘Salt Bones’ addresses the silence around missing women