By JOHN HANNA

The CEO of the nonprofit managing the Alamo resigned after a powerful Republican state official criticized her publicly, suggesting that her views aren’t compatible with the history of the Texas shrine.

Related Articles

Reagan Foundation becomes the latest US institution drawn into Donald Trump’s controversies

US starts investigating China’s compliance with 2020 trade deal as Trump heads to Asia

Trump administration won’t tap contingency fund to keep food aid flowing, memo says

Federal employees detail worries over shutdown layoffs

12,000 comments poured in on North Carolina’s new Trump-backed map. And they weren’t positive

Kate Rogers said in a statement Friday that she had resigned the day before, after Lt. Gov. Dan Patrick wrote a letter to the Alamo Trust’s Board of Directors suggesting that she either resign or be removed. Patrick criticized her over an academic paper questioning the GOP-controlled Legislature’s education policies and suggesting she wanted the historic site in Texas to have a broader focus.

“It was with mixed emotions that I resigned my post as President and CEO at the Alamo Trust yesterday,” Rogers said in a statement texted to The Associated Press. “It became evident through recent events that it was time for me to move on.”

Several trust officials did not immediately respond to email or cellphone messages Friday seeking comment.

Patrick had posted a letter to the board Thursday on X, calling her paper “shocking.” She wrote it in 2023 for a doctorate in global education from the University of Southern California. Patrick posted a portion online.

“I believe her judgment is now placed in serious question,” Patrick wrote. “She has a totally different view of how the history of the Alamo should be told.”

It is the latest episode in an ongoing conflict over how the U.S. tells its history. Patrick’s call for Rogers’ ouster follows President Donald Trump’s pressure to get Smithsonian museums in Washington to put less emphasis on slavery and other darker parts of America’s past.

The Alamo, known as “the Shrine of Texas Liberty,” draws more than 1.6 million visitors a year. The trust operates it under a contract with the Texas General Land Office, and the state plans to spend $400 million on a renovation with a new museum and visitor center set to open in 2027. Patrick presides over the Texas Senate.

In San Antonio, Bexar County Judge Peter Sakai, the county’s elected top administrator, decried Patrick’s “gross political interference.”

“We need to get politics out of our teaching of history. Period,” he said in a statement Friday.

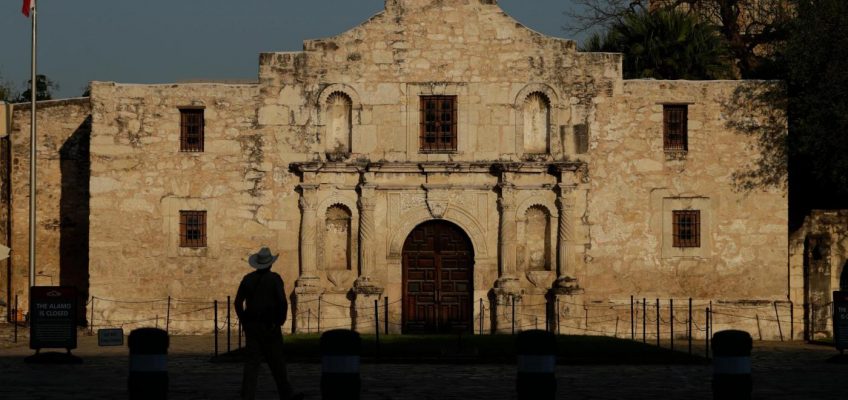

FILE – The Texas flag waves in front of the Alamo during a reenactment of the delivery of William B. Travis’ “Victory or Death” letter, Wednesday, Feb. 24, 2016, in San Antonio. (AP Photo/Eric Gay, File)

In the excerpt from her paper, Rogers noted the Texas Legislature’s “conservative agenda” in 2023, including bills to limit what could be taught about race and slavery in history courses.

“Philosophically, I do not believe it is the role of politicians to determine what professional educators can or should teach in the classroom,” she wrote.

Her paper also mentioned a 2021 book, “Forget the Alamo,” which challenges traditional historical narratives surrounding the 13-day siege of the Alamo during Texas’ fight for independence from Mexico in 1836.

Rogers noted that the book argues that a central cause of the war was Anglo settlers’ determination to keep slaves in bondage after Mexico largely abolished it. Texas won the war and was an independent republic until the U.S. annexed it in 1845.

Rogers also wrote that a city advisory council wanted to tell the site’s “full story,” including its history as a home to Indigenous people — something the state’s Republican leaders oppose. She said she would love the Alamo to be “a place that brings people together versus tearing them apart.”

FILE – In this Feb. 24, 2016, file photo, a member of the San Antonio Living History Association stands on the grounds on the Alamo as he waits to take part in a reenactment to deliver William B. Travis’ “Victory or Death” letter, in San Antonio. (AP Photo/Eric Gay, File)

“But,” she added, “politically that may not be possible at this time.”

Traditional narratives obscure the role slavery might have played in Texas’ drive for independence and portray the Alamo’s defenders as freedom fighters. Patrick’s letter called the siege “13 Days of Glory.”

The Mexican Army attacked and overran the Texas defenses. But “Remember the Alamo” became a rallying cry for Texas forces.

“We must ensure that future generations never forget the sacrifice for freedom that was made,” Patrick wrote in his letter to the trust’s board. “I will continue to defend the Alamo today against a rewrite of history.”