By MIKE SCHNEIDER, Associated Press

ORLANDO, Fla. (AP) — A federal judge in Florida is pushing for a resolution in a lawsuit over whether detainees at an immigration center in the Florida Everglades are getting adequate access to attorneys.

Related Articles

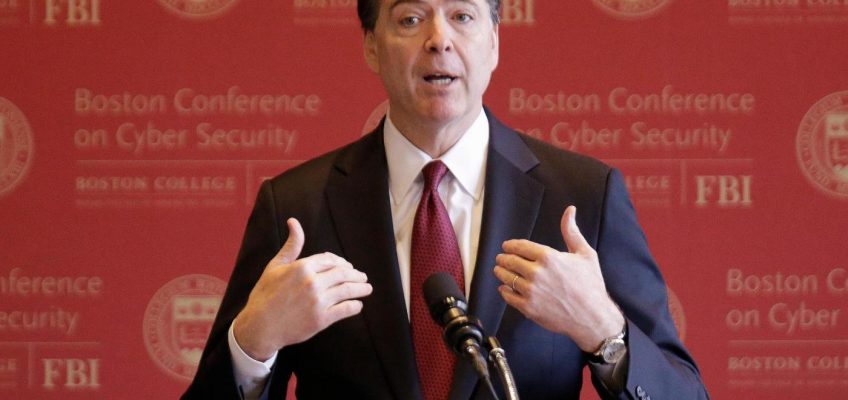

Justice Department says full grand jury in Comey case didn’t review copy of final indictment

What to know about expanded work requirements about to kick in for SNAP

US stocks climb ahead of a crucial couple of tests for Wall Street

Ford recalls more than 200,000 Bronco and Bronco Sports for instrument panel failure

Jurors hear closing arguments in trial of Ohio officer charged in the killing of Ta’Kiya Young

U.S. District Judge Sheri Polster Chappell last Friday ordered a two-day conference to be held next month in her Fort Myers courtroom, with attorneys present who have the authority to settle. The judge asked for an update at a hearing next Monday.

“The court will not entertain excuses regarding leaving early for flights or other meetings,” the judge wrote about next month’s conference.

The lawsuit filed by detainees against the federal and state governments over legal access is one of three federal cases challenging practices at the immigration detention center that was built this summer at a remote airstrip in the Florida Everglades by the administration of Republican Gov. Ron DeSantis.

In a separate environmental lawsuit, a federal appellate court panel in September allowed the center to continue operating by putting on hold a lower court’s preliminary injunction ordering the facility to wind down by the end of October. The appeal was put on hold during the government shutdown but resumed last week.

A third lawsuit claims immigration is a federal issue and Florida agencies and private contractors hired by the state have no authority to operate the facility.

President Donald Trump toured the facility in July and suggested it could be a model for future lockups nationwide as his administration pushes to expand the infrastructure needed to increase deportations. While the facility was built and operated by the state and its private contractors, federal officials have approved reimbursing Florida for $608 million.

In the legal access case, attorneys representing detainees at the Everglades facility are seeking a preliminary injunction that will make it easier for their clients to meet and communicate with their individual attorneys.

They claim that detainees’ attorneys must make an appointment to visit three days in advance, unlike at other detention facilities where the lawyers can just show up during visiting hours; that detainees often are transferred to other facilities after their attorneys have made an appointment to see them; and that scheduling delays have been so lengthy that detainees are unable to meet with attorneys before key deadlines.

Florida officials said in a motion to dismiss that the case is now moot since the concerns initially raised by the detainees and their attorneys have been addressed. Any delays were due to trying to construct a facility for thousands of detainees in a remote area with little infrastructure, they said.

“In other words, there is no longer a live controversy,” Florida officials said in their court filing.

Follow Mike Schneider on the social platform Bluesky: @mikeysid.bsky.social.