By SARAH PARVINI

LOS ANGELES (AP) — Nvidia on Wednesday reported a surge in fourth-quarter profit and sales as demand for its specialized Blackwell chips which power artificial intelligence systems continued to grow.

Related Articles

1099-K tax rules: What you need to know if you get paid via Venmo, Cash App or PayPal

Discussed on Reddit: How to survive a period of unemployment

Egg prices could jump another 41% this year, USDA says, as Trump’s bird flu plan unveiled

Slack platform down as users report service outage

BP to slash spending on net zero ventures as it focuses on oil and gas again

For the three months that ended Jan. 26, the tech giant based in Santa Clara, California, posted revenue of $39.3 billion, up 12% from the previous quarter and 78% from one year ago. Adjusted for one-time items, it earned 89 cents a share.

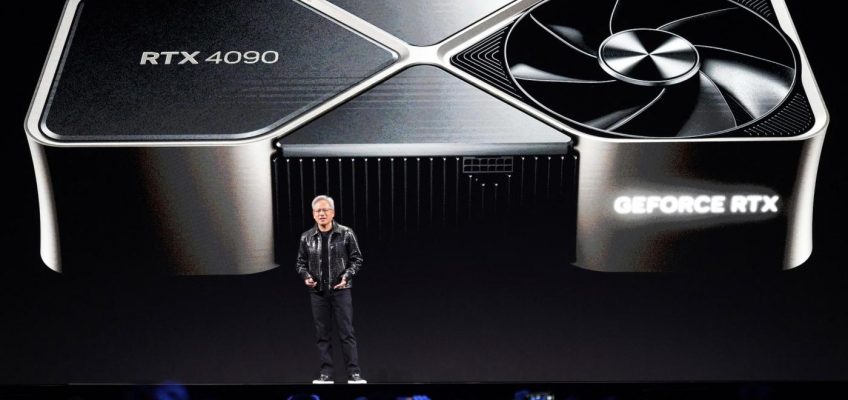

“Demand for Blackwell is amazing as reasoning AI adds another scaling law — increasing compute for training makes models smarter and increasing compute for long thinking makes the answer smarter,” Nvidia Founder Jensen Huang said in a statement.

Wednesday’s earnings report topped Wall Street expectations. Analysts had been expecting adjusted earnings of 85 cents a share on revenue of $38.1 billion, according to FactSet.

The fourth-quarter earnings are the company’s first report since Chinese company DeepSeek boasted it had developed a large language model that could compete with ChatGPT and other U.S. rivals, but was more cost-effective in its use of Nvidia chips to train the system on troves of data.

The frenzy over DeepSeek caused $595 billion in Nvidia’s wealth to vanish briefly. But the company in a statement commended DeepSeek’s work as “an excellent AI advancement” that leveraged “widely-available models and compute that is fully export control compliant.”

The poster child of the AI boom, Nvidia has grown into the second-largest company on Wall Street — it is now worth over $3 trillion — and the stock’s movement carries more weight on the S&P 500 and other indexes than every company except Apple.

Nvidia and other companies benefiting from the AI boom have been a major reason the S&P 500 has climbed to record after record recently, with the latest coming last week. Their explosion of profits has helped to propel the market despite worries about stubbornly high inflation and possible pain coming for the U.S. economy from tariffs and other policies of President Donald Trump.

Leave a Reply