By ALEX VEIGA, Associated Press Business Writer

LOS ANGELES (AP) — Skyrocketing housing values and a shortage of homes on the market gave homeowners the upper hand for years when it came time to sell. That’s no longer a given.

Across the country, it’s getting tougher for sellers to drive a hard bargain. A dearth of home shoppers who can afford to buy and uncertainty about the outlook for the economy, jobs and mortgage rates is putting pressure on sellers to give ground at the negotiating table.

In some markets, mainly in the South and West, homeowners who are eager to sell are more likely to give buyers a better deal. This could include a lower price, up-front money to nudge down the buyer’s mortgage rate, and funds for closing costs and any repairs or improvements that may pop up after the home inspection.

Related Articles

Business People: Adair Mosley to lead GroundBreak Coalition

Real World Economics: Farmers always on the cutting edge

A guide to earning and redeeming frequent flyer miles

Working Strategies: Pursuing two careers at once

With groceries more expensive than ever, here’s how to save money

The reasons: Would-be buyers balk at what they view as unreasonable asking prices, while at the same time new construction is giving buyers more options and putting pressure on sellers to make their homes more appealing.

As a result, while the national median home listing price rose slightly in July, some metro areas saw a decline, signaling a reversal in the power dynamic between buyers and sellers. It’s rare to see the type of eye-popping bidding wars that exploded home values by roughly 50% nationally earlier this decade. Low-ball offers are more common.

Despite this hopeful trend, the housing market remains mired in a slump. Sales of previously occupied U.S. homes are running about 1.3% below where they were through the first seven months of last year, when they sank to their lowest level in nearly 30 years.

The national median home listing price rose slightly in July from a year earlier to $439,450, according to Realtor.com. The real estate listing company found the most a homebuyer who earns the median U.S. household income can afford to spend on a home is $298,000. The analysis assumes a 20% down payment and a 30-year mortgage at a fixed rate of 6.74%. By those criteria, 7 out of 10 home shoppers are priced out of the market.

Homes linger on the market as sales slow

The housing market has been in a rut since 2022, when mortgage rates began climbing from historic lows. The number of homes available for sale sank while prices kept rising.

Nationally, more homes are going on sale and remaining unsold longer because buyers have been unwilling or unable to make a deal. Active listings — a tally that encompasses all homes on the market except those pending a finalized sale — increased in July for the 21st month in a row, climbing nearly 25% from a year earlier, according to Realtor.com.

The tide turns slowly

The inventory of homes for sale across the U.S. has increased gradually as the market has slowed and is now at a level where supply and demand are more balanced. But in states like Texas and Florida, the number of homes on the market has climbed sharply, partly because those states are hotbeds of new home construction.

Home shoppers may now have more leverage relative to sellers in the South and West, where home inventory has risen in the single digits, compared to pre-pandemic levels. Conditions are tougher in markets in the Midwest and Northeast, where the supply of homes remains 40% and 50% below pre-pandemic levels, respectively, according to Realtor.com.

Sellers feel the pinch and budge on price

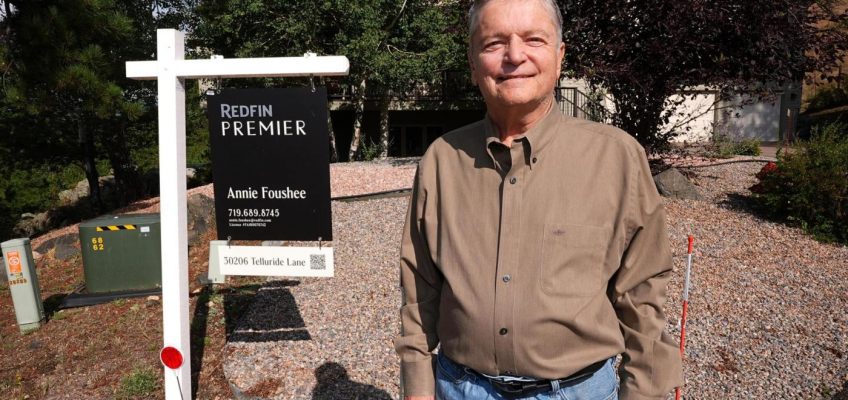

After roughly two months on the market and three open houses, Doug McCormick’s home has yet to receive a single offer.

The retired business owner and his wife initially listed the 4-bedroom, 4.5-bath house located in Evergreen, a mountain community about 30 miles west of Denver, for $1.3 million. They lowered their asking price to about $1.28 million. That, too, failed to bring in a buyer.

McCormick, 80, says he’s hoping mortgage rates ease a bit and bring out more buyers. But he’s also considering just renting the property.

“That’s something that’s kind of in the back of my mind,” he said. “I keep reminding myself you only need one buyer.”

McCormick’s situation is not unique. As demand has slowed, more sellers have resorted to lowering their initial asking price — often multiple times — to no avail.

“Even though we are seeing a substantial amount of price reductions, sometimes it’s not enough to move the home, it’s still sitting,” said Annie Foushee, an agent with Redfin in Denver.

The median home listing price in Austin fell 4.9% in July from a year earlier, while in Miami it dropped 4.7%. Among other metro areas that had sharp drops in their listing price were: Chicago (4.4%), Los Angeles (4.2%) and Denver (4%).

When buyers are also sellers

Lindsay Olesberg and her husband, John, know what it’s like to navigate both sides of the housing slump.

The couple listed their 4-bedroom, 3.5-bath home outside Albuquerque for $835,000 in June 2024 after John, a research scientist, got a new job in Texas. The plan: Sell their house, move to Austin and buy a home there. It took more than a year, during which the couple lowered their asking price several times, temporarily took the home off the market and had some offers fall through.

In the end, they agreed to sell for $40,000 below their original listing price.

Buying a home was much easier. The Olesbergs had little trouble finding homes they liked and could afford in Austin, where home inventory was up nearly 60% in July compared to pre-pandemic levels.

They bought a five-bedroom, three-bath house in Austin for $735,000, or $30,000 below its initial listing price. The seller also agreed to cover $1,000 in fees.

“We got less for our house in New Mexico than we would have wanted,” said Lindsay Olesberg, 59, a Bible teacher. “But at the same time, you also knew it was a buyer’s market in Austin, so the prices were coming down.”

Taking homes off the market

In markets where buyers now have the upper hand, sellers who can afford to wait are often opting to pull their listing rather than be pressured into coming way down on price.

Tammy Tullis put her home in the Miami suburb of South Miami on the market in June. But the four-bedroom, 3.5-bath house didn’t receive many offers initially, so she dropped her $2.8 million asking price by $100,000. That helped drive turnout during an open house, but she only received low-ball offers.

“They were like $400,000-$500,000 off the mark,” said Tullis, 51.

Last month, the finance consultant took the listing down. She may relist it sooner, rather than later.

“I want to sell, but I’m not in a rush-rush,” Tullis said.

Lower rates ahead?

The Trump administration has pushed the Federal Reserve to lower interest rates, saying doing so will help the housing market. But homebuyers – and politicians – should keep in mind that the central bank only directly influences short-term rates, while most mortgages are based on the yield of the 10-year Treasury. So, lower mortgage rates wouldn’t be a given, even if the Fed cuts rates in two weeks, as the market expects.

And while lower mortgage rates would boost home shoppers’ purchasing power, they also could bring in more buyers, giving sellers less incentive to keep lowering prices.

Economists generally expect the average rate on a 30-year mortgage to remain near the mid-6% range this year.

Leave a Reply