Top Democrats are urging the Biden administration to again extend the freeze on federal student loan payments before it expires next month, warning that requiring tens of millions of Americans to resume paying their debt will drag down the economic recovery.

Monthly student loan payments and interest are set to resume on Feb. 1 for the first time since the beginning of the pandemic when the federal government took emergency action to freeze the debt as the economy cratered in March 2020.

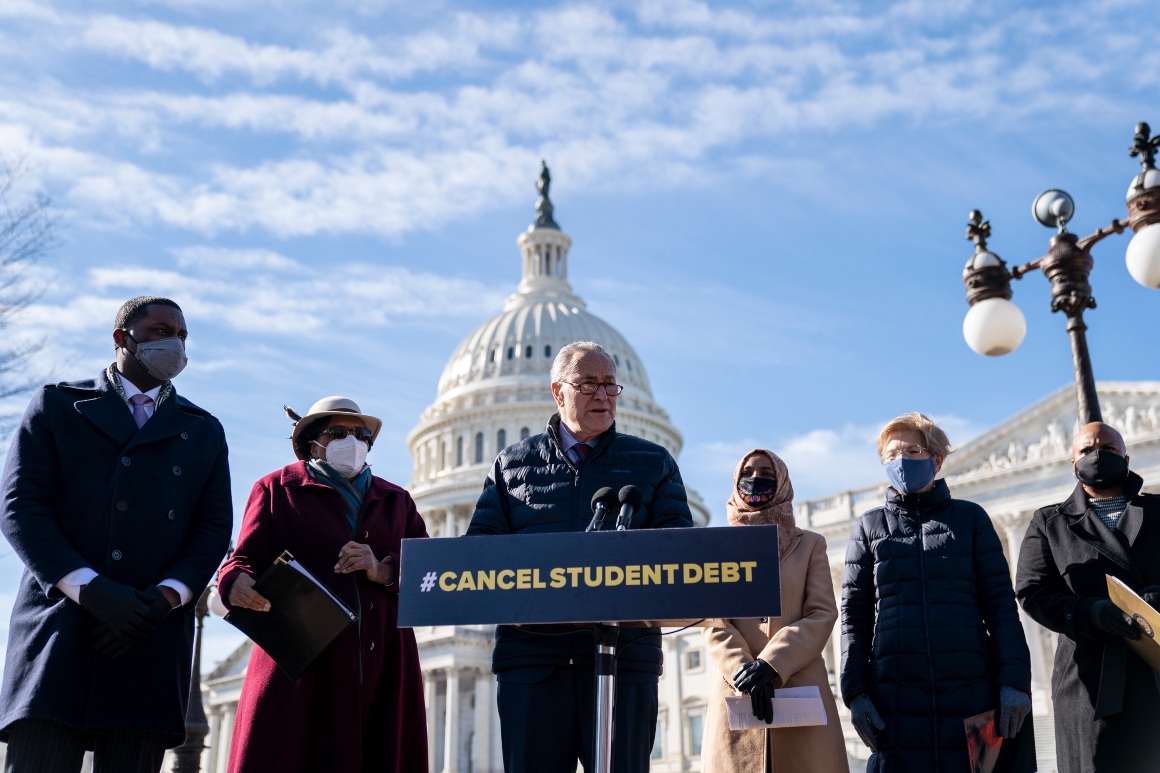

Majority Leader Chuck Schumer, Sen. Elizabeth Warren (D-Mass.) and Rep. Ayanna Pressley (D-Mass.), who for months have been urging President Joe Biden to cancel large amounts of outstanding student loan debt, are asking the administration to further extend the payment pause.

At a minimum, the lawmakers said in a letter this month to Biden, the administration should continue the freeze on student loans “until the economy reaches pre-pandemic employment levels.”

The lawmakers also released a new analysis by the progressive Roosevelt Institute, which estimates that some 18 million American families would have to collectively pay more than $85 billion next year if the Biden administration restarts payments as scheduled.

Those payments would “hurt individual families and the economy as a whole,” the lawmakers wrote to Biden, adding that the emergence of the Omicron “variant is a reminder the virus is still impacting parts of the economy and public health.”

White House press secretary Jen Psaki said Friday that the administration would release more details about its plans in the coming weeks and is “preparing for a range of steps” ahead of the Feb. 1 expiration.

“We’re still assessing the impact of the Omicron variant,” she said. “But a smooth transition back into repayment is a high priority for the administration.”

Mounting pressure for an extension: The letter comes amid growing calls on the left for the Biden administration to continue the relief for borrowers as the White House decides the broader question of whether to outright cancel student loan debt, which it has publicly said it continues to review.

A wide coalition of mostly left-leaning organizations, consumer advocacy groups and unions last week also called on the Biden administration to extend the payment pause.

The groups, led by the Student Borrower Protection Center, said in a letter to the White House that “a rush to resume student loan payments is a recipe for disaster and will result in widespread confusion and distress for student loan borrowers.”

Earlier last week, Sens. Raphael Warnock (D-Ga.) and Ron Wyden (D-Ore.) led a dozen other Senate Democrats in urging the Biden administration to at least continue to keep the interest rates on federal student loans at zero even if monthly payments resume on Feb. 1.

The Education Department has estimated that the waiver of interest on federal student loans alone saves borrowers about $5 billion each month.

Key context: Biden administration officials at the Education Department have repeatedly said they’re planning to resume the collection of student loans in February — for the first time in nearly two years.

Congress in March 2020 suspended monthly payments and interest on most types of federal student loans, and the Trump and Biden administrations have each used executive action to continue that relief.

The Education Department announced the most recent extension of the relief in August. Some White House officials at the time had been reluctant to issue that extension, which top Education Department officials had recommended, because of concerns that continuing the emergency program would undercut the administration’s messaging about the strength of the economic recovery.

The Education Department has already begun sending emails to borrowers reminding them that payments will resume in February. Department officials and their contracted loan servicing companies have been working to implement some new flexibilities for borrowers as they return to repayment next year.

Biden administration officials have said they are continuing to review proposals for a mass student debt jubilee. But in the meantime they’re focused on improving existing student debt relief programs targeted at specific populations of borrowers, such as public service workers or those with severe disabilities.

The Education Department has touted roughly $12 billion in student debt that has been forgiven under those existing federal programs since the beginning of the Biden administration.

Leave a Reply